A high-level panel discussion organised by the Community of European Railway and Infrastructure Companies (CER) to debate the European Commission’s (EC) proposed directive on Multi-Modal Digital Mobility Services (MDMS) has warned that legislators must be careful not to enable the dominance of digital platforms through the new legislation.

But AllRail, which represents private operators in Europe, has said in response that it is in fact existing national operators who dominate the ticketing market.

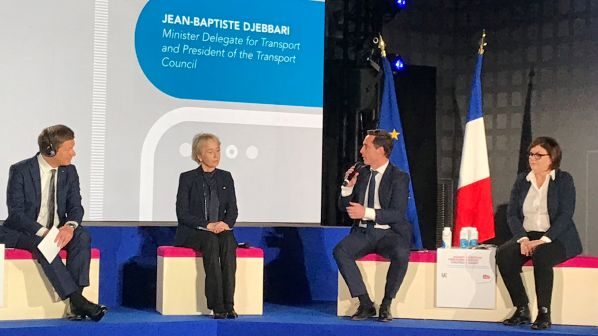

The debate on April 24 was hosted by MEP Ms Maria Grapini, vice-chair of the European Parliament’s Committee on the Internal Market and Consumer Protection (Imco) and a member of the Transport and Tourism Committee (Tran).

It heard that the rail sector is already making progress in implementing e-ticketing and providing real-time travel information in compliance with existing legislation.

The debate was attended by EC representative, Ms Charlotte Nørlund-Matthiessen from the cabinet of the transport commissioner, Ms Adina Vălean, Mr Agustin Reyna of the European Consumer Organisation (BEUC), Ms Heike Luiten of NS International, and CER executive director, Mr Alberto Mazzola.

The debate raised a number of crucial issues that CER says will need to be taken into consideration in drafting any new legislation.

These include recognising that sector-based solutions should be supported and considered as the starting point when improving multimodal ticketing. CER says the EC proposal must provide a legal framework where operators are not deterred from innovating, meaning they have ownership of proprietary solutions; where commercially sensitive insights are protected; and where incentives to invest in ways of generating value through the entire transport chain are preserved.

CER says the economics of operators and ticket retailers also need to be properly considered to avoid undermining profitability or substantially increasing ticket prices.

The association called for the EC to avoid the dominance of digital platforms, saying that unless capped at a low level, distribution commissions increase the risk that well-funded tech giants with limited investment in distributed services “would enjoy guaranteed profits at the expense of transport service providers, public-sector budgets and, ultimately, consumers.”

Finally, the CER says the MDMS initiative must ensure that transport companies and authorities have full access to any data on inquiries and usage received by the sales platforms at all times. “The mobility market is developing at a highly dynamic pace, thus operators need to constantly innovate their products to best serve the customers’ needs and expectations,” CER said in a statement following the debate.

“The CER Ticketing Roadmap lays out a series of commitments by CER members that seek to achieve a seamless ticketing experience by 2025,” Mazzola says. “In the upcoming MDMS proposal, it is crucial to consider that, along with speed, cost is the most significant factor when selecting a mode of transport for long-distance journeys. Given the divergent economic interests of transport operators and ticket vendors, the MDMS proposal must avoid raising passenger fares.”

Responding to CER’s statement, the secretary general of AllRail, Mr Nick Brooks, said the proposal itself was extremely promising, and shows that the EC serves its citizens well by demonstrating a thorough understanding of the current fragmentation in EU passenger rail ticketing.

“EU citizens fund the vast majority of rail infrastructure and 70% of EU passenger rail services by means of Public Service Obligations (PSOs),” he says. “Therefore, it is common sense that they deserve to be able to search and book all passenger rail options between any two stations in Europe in a transparent manner using MDMS digital platforms. EU passenger rail is the only transport sector with high subsidy and low delivery, and this cannot continue.”

But Brooks said he was “stunned” that the argument of avoiding the dominance of digital platforms over operators was being used.

“It is hypocrisy, because evidence shows that it is the incumbent in-house digital ticket vendors’ platforms that are clearly showing market dominance over operators,” he says. “They refuse to show independent operators and refuse to share all the necessary data with independent ticket vendors to enable competition in the market.”

He pointed to German Rail (DB) and Spanish national operator Renfe, which are both under investigation for potentially abusing their market position.

“By contrast, there is actually zero evidence of any independent rail ticket vendor being investigated for market dominance,” Brooks says. “And how could they, with less than 5% market share? It is a matter of urgency that Europe’s competition authorities act against the market dominant in-house rail ticketing platforms of the state rail incumbents.”