MARRAKECH’s Grand Palais in the modern district of the ancient city, a stone’s throw from the mainline station, played host to the great and the good of the international high-speed rail community on March 7-10.

The glitzy graphics, dynamic soundtrack and well-rehearsed set pieces were befitting of high-speed’s status as the rail sector’s glamour child. Yet long-distance high-speed rail transport has experienced a difficult period. It was five years since the last gathering in Ankara, Turkey, with the Covid-19 pandemic since playing havoc with operators’ revenue and ridership. However, there was a feeling of relief among delegates that they were back together, and that the worst of the pandemic is now over. Online meetings are fine, but they do not offer the chance for one-on-one personal discussion where many reported that the “real work” takes place.

The Covid-19 pandemic resulted in the cancellation of the planned event in Beijing in 2020 with Moroccan National Railways (ONCF) stepping in as hosts, achieving what ONCF’s deputy CEO, Mr Mohamed Smouni, said was a long-term ambition for the railway since it began its high-speed journey in the late 2000s.

ONCF launched commercial operation of its 183km Tangier - Kenitra high-speed line in 2018, the first in Africa. Morocco was welcomed into the club of countries operating a high-speed railway during the congress, an achievement that UIC secretary general, Mr François Davenne, said shows that high-speed rail is no longer a preserve of wealthy nations.

The Al Boraq service continues on the conventional mainline to Casablanca and many delegates took the opportunity to ride one of ONCF’s eight-car double-deck high-speed trains, which was sent especially to Marrakech to carry technical tour attendees.

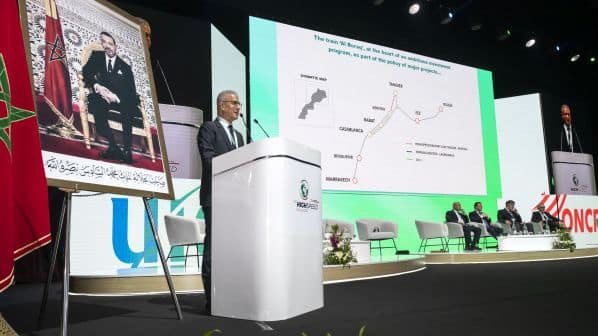

ONCF hopes the sight of the train in Marrakech is not a one-off. Delegates heard about the country’s wider ambitions to extend high-speed infrastructure to support operation at 320km/h on a new 392km alignment from Kenitra to Casablanca and Marrakech, and ultimately another 239km to Agadir on the Atlantic Coast.

The Kenitra - Marrakech project is split into three sections where preliminary design studies are underway. Moroccan companies are working with international partners on the studies: a consortium of French firms Novec and Ingérop are working on the 150km Kenitra - Ain Sebaa section; Setec, France, on the 130km Ain Sebaa - Nouaceur section; while Dohwa Engineering and Korean National Railways are working on the 212km Nouaceur - Marrakech stretch. In addition, Egis Rail was appointed as general consultant for external control on the project in November. Egis is expected to coordinate these design studies and the various parties working on the project as well as deciding sequencing.

ONCF hopes to commence land acquisition by the end of this year, which is expected to take 18 months to complete. Construction of the Kenitra - Casablanca section is expected to take five years, with work between Casablanca and Marrakech estimated to take four years. Construction of the line to Agadir, although a little further behind in terms of planning, is expected to take place in parallel and conclude at the same time.

Public-private partnership

Smouni told IRJ that the railway and the government are exploring various financing options for the estimated Dirhams 50bn ($US 4.87bn) project, including a public-private partnership (PPP). France, which supported the Tangier - Kenitra project, has been mentioned as a possible source of funding along with China. Ultimately a decision is expected on how the project will proceed by the end of this year.

Other planned projects which ONCF is exploring under its Plan Rail Morocco 2040 masterplan include extending the high-speed service from Tangier on the conventional mainline from Kenitra to Meknes and Fez. Together the network would serve 90% of the country’s cities and play a major role in modal shift helping to decarbonise transport, a stated ambition of Moroccan transport minister, Mr Mohammed Abdeljalil.

The railway is also keen to develop RER-style commuter railways in major cities, including Marrakech, using capacity on existing lines freed up by the construction of the high-speed network. ONCF CEO, Mr Mohamed Rabie Khlie, says services are envisaged between Kenitra and Bouznika and on the Mohammedia - Nouaceur, Casablanca - El Jadida, and Marrakech - Ben Guerir routes, and he is hopeful that operation could begin by 2030. In addition, there are proposals to extend the conventional network from Marrakech to Agadir, and potentially to Laayoune in Western Sahara.

There are proposals to extend the conventional network from Marrakech to Agadir, and potentially to Laayoune in Western Sahara.

Khlie also revealed during a press conference that ONCF is in the market for 100 new EMUs to boost its mainline offer. Further details on tendering for the contract are expected imminently. “We expect all of the main suppliers to be interested in this contract,” Khlie said.

Delivery of the trains is expected to take place from 2025 up to 2030 and they would replace much of the country’s ageing locomotive-hauled coaching stock, allowing the redeployment of 20 Prima 2 locomotives ordered from Alstom in 2008. ONCF’s intention is for the new fleet to be built in Morocco, with Khlie telling local media that with another 50 trains required for RER and local rail projects, there is sufficient demand for such a manufacturing facility, the country’s first, which would also be expected to export. The supply contract is expected to include a 20-year maintenance element.

IRJ’s experience of the Moroccan mainline network was positive. Trains were busy and punctual with little sign of a pandemic-induced hangover on passenger traffic. Indeed, ONCF reports that its Al Boraq high-speed service carried 4.2 million passengers in 2022 and the railway is aiming to carry 5 million in 2023. This compares with 3 million passengers in 2019.

Covid-19 recovery

The opening session of the congress heard about the wider high-speed community’s recovery from Covid-19. Amtrak president and CEO, Mr Stephen Gardner, revealed that the national operator is carrying 95% of its pre-pandemic passengers despite only having 85% of capacity. The start of operation with its new Avelia Liberty high-speed fleet cannot come soon enough.

Similarly, in Korea, Mr Hanyoung Kim, president of Korean National Railway (KNR), reported that while high-speed ridership fell by 35% in 2020 and 2021, the tide began to turn in 2022 with 92% of pre-pandemic passengers returning. He expects this to go beyond 100% of 2019 ridership in 2023, emphasising the importance and attractiveness of the country’s growing high-speed network.

Other delegates noted the impact of tele-working on the profile of their passengers. Mr Rodrigo Villalante, Renfe’s general director of strategy and development, said that while this has not been as marked as at some of its European counterparts, the Spanish national operator has been forced to respond to changing ridership patterns.

Leisure travellers are increasingly making up a greater proportion of ridership, including for Trenitalia, as revealed by Mr Andrea Minuto Rizzo, its head of European and international affairs. Gardner said that leisure now accounts for 40% of all of Amtrak’s journeys with a third of riders new customers, while 25% of Northeast Corridor (NEC) passengers are new to rail. The proportion of business travel has fallen from 80% to 60%.

ONCF reports that its Al Boraq high-speed service carried 4.2 million passengers in 2022 and the railway is aiming to carry 5 million in 2023.

Sustainability was a major theme of the event. Rail was consistently held up as playing a critical role in offering green transport options that will help to reduce greenhouse emissions. Mr Alain Krakovitch, CEO of SNCF Voyageurs, made a notable point that doubling public transport use in France has been shown to reduce the country’s overall emissions by 30%. Likewise, Mr Michael Peter, CEO of Siemens Mobility, pushed back against the notion of rail’s relatively high cost when compared with other modes. He said that the capacity of 25,000 cars, which together cost €500m, is the same as a single high-speed train priced at €50m, which also offers a saving of 22,000kg of CO₂.

ONCF proudly pointed out the growing proportion of the traction energy it sources from renewables, which is expected to account for 50% of ONCF’s entire needs this year and 100% by 2024. In addition, local media revealed that the railway is planning to develop a prototype locomotive powered by green hydrogen. If successful, ONCF could potentially tap into domestic green hydrogen production facilities, which Morocco is actively exploring with a view to exporting the fuel to markets including Germany.

Presented under the title “The right speed for our planet,” part of the debate focused on what contributors felt is the optimal speed for high-speed operation, a talking point especially pertinent given the current energy crisis.

An interactive survey of attendees found that the majority favoured speeds of 300-350km/h. Only a handful voted for speeds beyond 350km/h, with China Railway (CR) the only railway to publicly state its ambition to pursue ever higher speeds. Director general of science and technologies, Dr Zhou Li, reasoned that doing so will further reduce journey times between major cities, CR’s biggest ambition.

For others, sobriety was the order of the day. Contributors spoke of the need to improve integration rather than going faster and faster to compete with other modes of transport, including air travel. Adif president, Ms María Luisa Domínguez, highlighted the Spanish infrastructure manager’s work to transform railway stations into multi-modal hubs. Villalante also stressed Renfe’s partnership with active mobility providers.

Other ideas were presented on the importance of improving the experience of high-speed rail for passengers to encourage modal shift, including offering improved and affordable ticketing, onboard Wi-Fi, and attractive catering options.

There was also support for on-track competition as a means to grow overall ridership. Domínguez repeated the positive experiences of the opening of the high-speed market in Spain as did Rizzo for Italy. Yet with progress with market opening slow, this remains an area where rail can improve. A press release issued by AllRail during the conference highlighted the absence of any on-track competition in Morocco, a prospect that was not raised during the event.

While possible financing of future rail projects was only loosely touched upon, significant time was reserved in the public sessions for discussion of current and future rail projects.

UIC passenger director, Mr Marc Guigon, presented an interesting snapshot of high-speed network growth since the first line opened in Japan in 1964, which has increased dramatically since China accelerated its high-speed railway construction programme in the late 2000s. China’s 45,000km network dwarfs the next largest, Spain, which stands at 3681km. Guigon reported that 19,718km of high-speed railway is currently under construction, which if all completed would increase the global total from 58,839km in 2021 to 78,557km. Of these lines, 14,376km are in Asia-Pacific, mostly in China, with 3062km in Europe, 2006km in the Middle East, and 274km in North America.

The prospects for new members to join the high-speed railway club were discussed on the final morning. Portugal, Poland, the UAE and Qatar were among those joining their more established peers in talking up their respective plans. It is hoped that many of these projects will be making strong progress when the community gathers again in Beijing in 2025. China’s remarkable achievements will certainly offer plenty of inspiration.