ALMOST one month after US Class 1s Canadian Pacific (CP) and Kansas City Southern (KCS) announced their intent to merge into Canadian Pacific Kansas City (CPKC) under a $US 29bn deal, Canadian National (CN) has made a counter-offer that it says is a “superior proposal” that “will result in a safer, faster, cleaner and stronger railway.”

CN’s proposal of $US 325 per KCS share “represents a 21% premium over the implied value of the CP transaction and values KCS at an enterprise value of $US 33.7bn.”

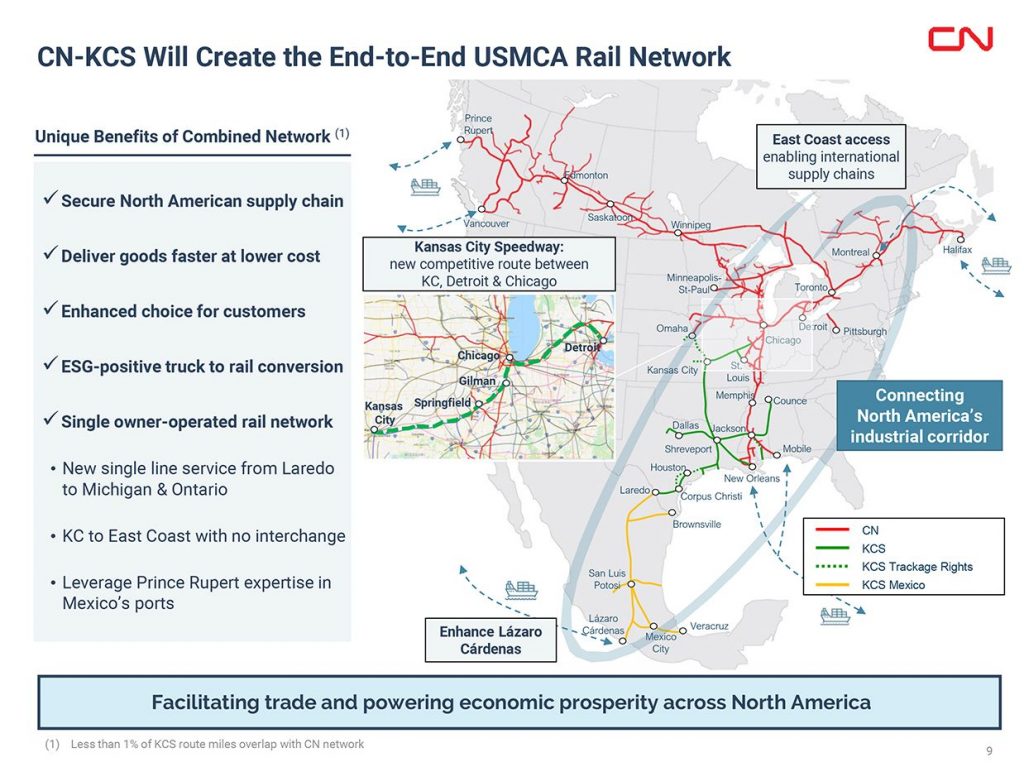

Combining CN and KCS “will create the premier railway for the 21st century, connecting ports in the United States, Canada and Mexico to facilitate trade and economic prosperity across North America… providing superior service, enhanced competition and new market access to move goods across North America efficiently and safely,” CN says.

“This rail and logistics network would reduce traffic congestion and prevent thousands of tonnes of greenhouse gas emissions from entering the atmosphere every day. This combination will also significantly expand the combined company’s total addressable market and provide growth opportunities across the rapidly growing United States-Mexico-Canada Agreement (USMCA) network.”

“We expect the combination to expand the total addressable markets by approximately $US 8bn across the Canadian trans-border, the US domestic, and the rapidly-growing Mexico-US markets,” CN said in a letter to KCS shareholders. “The combined network and the deployment of CN’s innovative, advanced technologies will produce unparalleled stakeholder benefits. We intend to add more fluid, rapid and cost efficient options across network points like Laredo, Michigan, Southern Ontario and Detroit, for both new and existing customers.”

CN says it has highly complementary networks with KCS, with less than 1% overlap.

The Numbers

CN is valuing its proposed cash-and-stock transaction at $US 33.7bn, or $US 325 per share, based on a 0.799 exchange rate between the Canadian and US dollars, and on CN and CP closing share prices on the New York Stock Exchange of $US 118.13 and $US 365.37, respectively, as of April 19. Following closing into a voting trust, KCS shareholders would receive $US 200 in cash and 1.059 shares of CN common stock for each KCS common share.

CN said its proposal of $US 325 per KCS share “represents a 27% premium to KCS’ closing share price as of April 19 2021; a 45% premium to KCS’ closing share price as of March 19, 2021 [the last trading day prior to KCS’ announcement of its proposed transaction with CP]; a 21% premium to the implied value of the proposed transaction with CP based on each of CN’s and CP’s closing share price on April 19; and $US 56 in additional value per share to KCS shareholders above the proposed transaction with CP.”

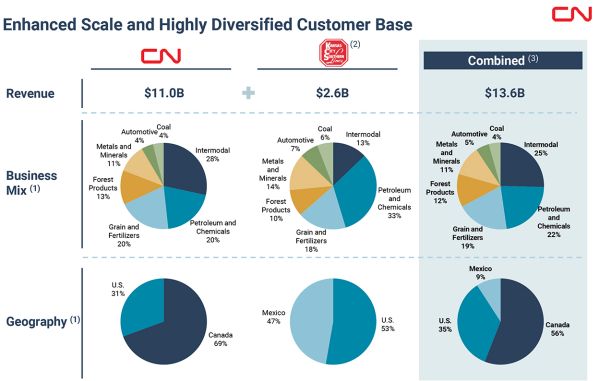

CN said it currently estimates that the combination would result in up to $US 1bn in Ebitda synergies annually, with the vast majority of synergies coming from additional revenue opportunities, with a significant proportion expected from attracting road freight.

In the letter to KCS’s board, CN says the cash portion of the acquisition will be funded through a combination of cash-on-hand and approximately $US 19.3bn of new debt. Upon closing of the transaction and including the assumption of approximately $US 3.8bn of KCS debt, CN expects to have outstanding debt of approximately $US 33.6bn.

Based on the proposed exchange ratio and CN’s current quarterly dividend of $C 0.615 ($US 0.493) per share, KCS shareholders are expected to receive the equivalent of $US 2.08 in annual dividends per KCS share, which is approximately 40% higher than the pro forma dividend per share under the CP proposal.

CN has engaged JP Morgan and RBC Capital Markets as financial advisors, and says it has finalised $US 19.3bn of financing commitments from them.

“CN is ideally positioned to combine with KCS to create a company with broader reach and greater scale, and to seamlessly connect more customers to rail hubs and ports in the US, Mexico and Canada,” says CN president and CEO, Mr JJ Ruest. “CN and KCS have highly complementary networks with limited overlap that will enable them to accelerate growth in single-owner, single-operator, end-to-end service across North America. With safer service and better fuel efficiency on key routes from Mexico through the heartland of America, the result will be a safer, faster, cleaner and stronger railway.”

“We firmly believe our proposal is far superior to KCS’ existing agreement with CP because it offers superior financial value over the immediate and long-term, a more complementary strategic fit, greater choice and efficiencies for customers and enhanced benefits for employees and local communities,” says CN chair, Mr Robert Pace. “We look forward to engaging constructively with KCS’ Board and all relevant stakeholders to deliver this superior transaction.”