First-half revenue plunged by 21% to €14.1bn resulting from strikes against pension reforms which cost €275m, and government-imposed travel restrictions to combat Covid-19 which started on March 17 and cost €3.9bn in lost revenue.

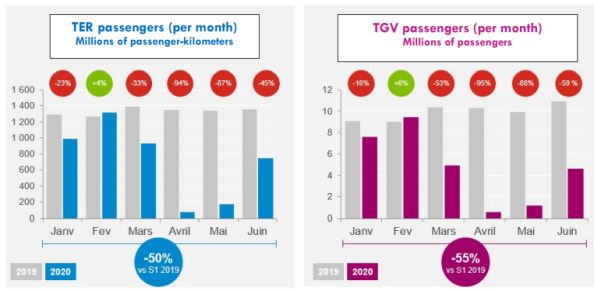

Following the January strikes, SNCF achieved a 4% increase in TER regional passenger traffic and 6% growth in TGV high-speed patronage. However, growth came to an abrupt end in March with the start of the national lockdown.

In April, SNCF cut rail capacity to 7% of normal for TGV services, 34% for Transilien commuter services in the Paris area, and 16% for TER. International services were severely curtailed with only 8% of Eurostar and Thalys trains running. Around 70% of freight trains continued to operate.

Passenger services started to resume in May, but with lower train occupancy levels than normal due to social distancing requirements. As of June 30, Transilien was running 98% of timetabled services, TER 87%, and TGV 70%, while rail freight was running nearly 85% of normal services. SNCF’s logistics subsidiary, Geodis, reported worldwide business hovering between 90% and 100% of normal levels in June.

SNCF introduced post-lockdown promotions in June to stimulate passenger traffic. This included offering 5 million TGV, Ouigo and inter-city tickets for less than €49. SNCF expects these offers to generate a “significant increase in train occupancy this summer.” Low-cost Ouigo high-speed services were introduced between Paris and the centre of Lyon in July ahead of the route opening up to competition.

Recovery plan

SNCF will launch a passenger traffic recovery plan in September focussed on adapting fares and digital tools to reflect new passenger behaviour patterns such as working from home.

In April, SNCF expanded its action plan, originally introduced in January to combat the financial impact of the strikes, to limit the fallout from the pandemic. The plan is aimed at cutting operating costs, postponing or cancelling investment projects, and managing cash strictly.

“At the end of June, this plan had already improved free cash flow by €1.1bn, with +€350m in cost reductions (including short-time working), +€130m in cuts to projects and investments, and +€600m from activating cash flow levers,” SNCF says. “The plan’s impact will continue into H2 2020, improving liquidity by €1.8bn over the full year. This unprecedented effort will have no impact on jobs in the rail sector proper, nor will it affect essential investment in the network or in rail operations.” As a result, investment fell from €4.3bn in the first half of 2019 to €3.7bn in the first half of 2020.

Difficult

“It is still difficult to judge the long-term financial impact of the Covid-19 pandemic with any degree of precision, given the high level of uncertainty about how and when the crisis will end, and what the economic fallout will be,” SNCF says. “It will also depend on SNCF Group’s ability to maintain its rebound, in particular through special measures to support economic recovery in France and around the world.”

SNCF says it hopes to reach an agreement with the government before the end of the year to define a financial support package. Nevertheless, SNCF says it has sound financial liquidity. In mid-July SNCF had liquid resources of €6.8bn and a credit facility of €3.5bn.