Much of the current record level of overall growth is due to two years of extremely high procurement in Russia, the world's largest freight wagon market. However, Russia's growth rate is set to fall by 14% per year after these procurements were found to be more than enough to meet long-term demand, meaning that overall market expansion is unlikely to match 2011-12's figures in the foreseeable future. Continued growth is expected in the after-sales service market, which is currently worth €9bn per year, due to increases in overall fleet sizes.

Despite the upcoming growth contraction in Russia, the market will continue to grow markedly in other regions. Asian railways are projected to increase orders for new freight wagons by 8% annually up to 2017, while the relatively small markets of the Middle East and Africa are also set to grow by 14% year-on-year. In spite of difficult economic circumstances in Europe which means that its market size remains at historically low levels, the withdrawal of life-expires wagons is prompting growth of slightly less than 3% per year. And in North America, what SCI Verkehr describes as a "demand boom," is prompting steady growth of 3% per year.

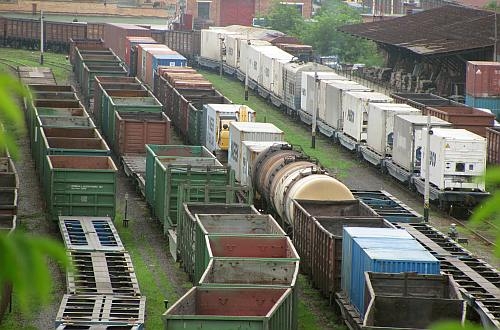

Driven by demand for raw materials, open wagons are the most important type of freight wagon yet the decline in the Russian market has resulted in a slump in demand. An increase in containerisation is driving sales of flat wagons while growing demand for oil products will increase the need for tank wagons, particularly in North America.

At present, 45% of freight wagons around the world are owned by incumbent railways compared with 55% in 2010, reflecting the growth of smaller private companies.

The study also found that the growth of Chinese manufacturers has resulted in a slight shift in the behaviour of freight wagon manufacturers which traditionally have supplied a single continent or secured their largest orders from within their home market. Manufacturers from China are increasingly delivering to Africa and South America, and more recently to Australia and the Asian region of the CIS. They are also making the first tentative steps into the European marketplace.

The study is currently available in German with an English version set for release next month. For more information visit www.sci.de