PUNCTUALITY has declined massively in Germany this year due to a combination of temporary speed restrictions and the large amount of maintenance work being undertaken by DB Network. In the first half of 2022, only 69.6% of long-distance trains reached their destination on time, compared with 79.5% in the first six months of 2021. Long distance punctuality fell to as low as 57% in June and recovered a little to 59.9% in July. Overall punctuality of German Rail (DB) passenger services in Germany reached 92.5% in the first half of the year.

The situation was exacerbated by the 9-euro ticket offer which ran from June to August with trains delayed at stations due to the large numbers of people trying to board and alight from trains and the need to couple additional coaches.

To make matters worse, DB undertook precautionary inspection and testing of around 200,000 concrete sleepers in July and August following the fatal derailment of a regional double-deck train near Garmisch-Partenkirchen on June 3. Sleepers of a particular type and from a single manufacturer were being examined by the investigating authorities as a possible contributory factor to the accident. As a result of the national investigation, there were restrictions at around 165 points on the rail network as IRJ went to press with the states of Bavaria, Saxony, Saxony-Anhalt and Thuringia the worse affected.

During the inspection programme DB introduced speed restrictions at some locations and even closed some sections of line resulting in train diversions or replacement bus services. DB says it has already been able to replace the sleepers on the first routes and dates for sleeper replacement have been scheduled for around 90% of the affected sections. DB expects most of the affected lines to reopen to traffic by the end of the year. The cost of the work is estimated at a three-digit million-euro amount.

“The current problems with reliability and quality are essentially due to a lack of capacity and outdated systems,” DB’s CEO, Dr Richard Lutz said at the end of May. There have never been so many trains operating on the German network as there are today, but the network itself has not grown to meet this increasing demand. Lutz says that at the same time, the quality of the infrastructure has continued to deteriorate because many systems are outdated and therefore prone to failure: “We must and will tackle this together - the federal government, the railways and the entire industry.”

Lutz says passengers are returning to the network sooner than expected after the Covid-19 pandemic, and freight traffic is also rising faster than anticipated. “Current demand confirms our basic conviction that the growth and modal shift goals of the federal government are realistic,” he says.

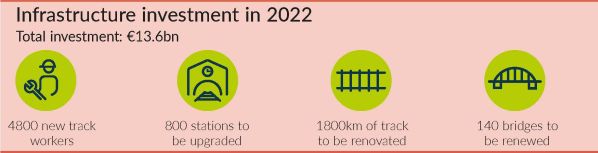

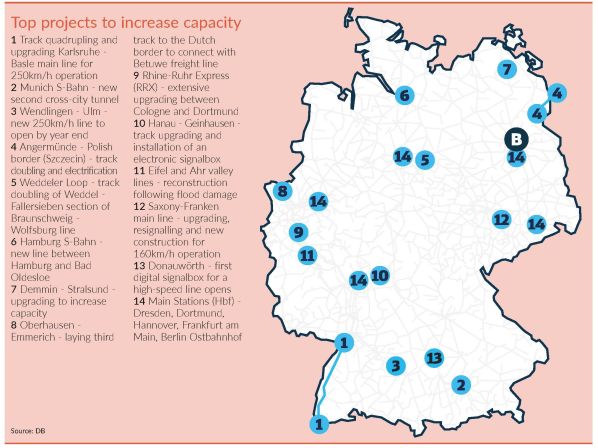

This year, infrastructure manager DB Network will spend a record €13.6bn - around €900m more than in 2021 - under its New Network for Germany investment programme, which is funded by DB, the federal government and the federal states. With this money, DB will modernise and renew around 1800km of track, 2000 points, 140 bridges and 800 stations (see chart). “Despite the current challenges posed by the war in Ukraine and the consequences of the coronavirus pandemic, we expect to be able to implement these investments as planned by the end of the year,” DB says.

To put this in perspective, a study of European rail infrastructure investment per capita in 12 European countries in 2021 conducted by Germany’s Pro-Rail Alliance (Allianz pro Schiene) and SCI Verkehr showed Germany fourth from bottom, ahead of France, Spain and Italy. The 2021 increase in German infrastructure spending pushed Germany ahead of Italy for the first time. However, Pro-Rail Alliance expects Germany to fall back again this year. This is because funds provided by the federal government to DB in connection with the 2030 climate protection programme were subsequently paid out in 2021 for 2020 as well.

Digitalisation

DB says it is pushing ahead with its digitalisation projects this year, with a focus on the Digital Node Stuttgart and the Scandinavian-Mediterranean Corridor from Hamburg via Erfurt and Munich to the Austrian border near Kufstein. Rolling out ETCS across the network will also continue, and the first digital interlocking on a high-speed line will begin operating in Donauwörth in Bavaria.

However, according to a study by SCI Verkehr, the installation of ETCS is lagging behind other countries and DB Network plans hardly any significant installations by 2030, which means it will miss its target of equipping the entire network by 2035.

In June, Lutz and the federal transport minister, Mr Volker Wissing, announced plans for a high-performance network covering the most congested lines which account for 10% of the network and carry around 25% of all services. This core network, which comprises 3500km, is currently at 125% of capacity. The size of the core network is expected to be expanded to 9000km by 2030.

DB and the federal government together with other public authorities and operators, transport associations and the construction industry are currently coordinating the detailed selection and sequencing of the corridors. “The decisive factors are the amount of traffic on the corridors and the foreseeable need for construction within this decade,” DB explains. In addition, adequate diversions and alternatives must be available and in good time. The objective is to launch the project before the end of this year.

high-performance network. Photo: Shutterstock/Topae

“The aim is to transform today’s highly congested corridors into the backbone of rail transport in Germany,” DB told IRJ. “It is about creating corridors which have high availability and performance that can accommodate more trains than today and that are geared towards growth.”

The high-performance network will have what DB describes as a first-class standard of equipment resulting from comprehensive track replacement, fewer level crossings and sufficient tracks and switches to allow slow trains to overtake fast trains to make rail operation more flexible and to allow a high level of service to continue at times of disruption. DB will also install high-quality and more reliable equipment on these lines instead of making like-for-like replacements, while monitoring and diagnostic systems will be installed to enable condition-based maintenance.

This will be achieved by carrying out a comprehensive renovation of the designated corridors across all disciplines from 2024. “This means that all construction measures for the coming years will be bundled together,” DB says. “We will tackle sleepers, ballast, tracks, switches, signals, signalboxes and stations. The high-performance network lines will also be prepared for digitalisation.” DB says each line will be closed once for the renovation work to be carried out and will then be virtually free of construction work for many years.

To mitigate the potential disruption from closing an entire line, DB says it will inform passengers and freight customers two years in advance of the impending line closures and diversions. A feature of the German rail network is the availability of many parallel lines, particularly in the Ruhr area and between Frankfurt am Main and Karlsruhe. DB plans to carry out intensive maintenance on the diversionary routes to avoid any additional delays to diverted trains from malfunctioning infrastructure. DB says this strategy will also relieve the burden on construction planning nationwide.

However, diversionary routes are not readily available everywhere. The most important exception is the Karlsruhe - Basle main line south of Rastatt which is the main artery for freight travelling from Italy and Switzerland to North Sea ports and is currently being rebuilt to convert it into a four-track 250km/h line and to accommodate freight trains up to 740m long and 2000 tonnes in weight. In August the Swiss railway industry complained that disruptive work sites and insufficient diversionary routes are causing so much strain “that regular freight transport operation is hardly possible anymore. Already today, shippers are showing a tendency to shift back to the road, especially for time-sensitive goods.”

The Swiss group wants the line from Basle through France along the left bank of Rhine to Wörth near Karlsruhe to be upgraded for international freight traffic, but this depends on cooperation from French National Railways (SNCF).

Challenges

DB faces two immediate challenges in implementing the high-performance network: inflation and a shortage of materials.

“Like the entire economy, we are also feeling the effects of current market price developments,” DB told IRJ. “The price increases are clearly visible in the bids from construction companies. The issue of material shortages is also not bypassing us. We are meeting these challenges with flexible planning of construction sites. The goal is to avoid project delays. Through great efforts, we have succeeded so far, except for a few individual cases, and the construction sites are running stably. In addition, we are in close contact with the construction industry about developments on the market to find solutions together.”

Thanks to its continuing recruitment offensive, DB does not foresee a shortage of labour. “We are increasing our recruitment target for 2022 by another 15% to 24,000,” DB says. “The fact that DB has continued to invest in staff and trains at record levels and has maintained its growth trajectory is proving to be spot on with the boom in demand, particularly in passenger transport. Despite the coronavirus crisis, DB has hired at record levels in recent years. In 2021, we allocated around 5000 places to young talent - in 2020 it was just over 4700. We need the young talent to achieve the goals we have set ourselves with our Strong Rail strategy.”

The decisive factors are the amount of traffic on the corridors and the foreseeable need for construction within this decade.

The new high-performance network strategy has cast some doubt on what will happen on the rest of the network. In January 2020, the 10-year service and financing agreement (LuFV III) to maintain and modernise the existing network envisaged investment of €89bn up to 2029. However, until plans for the corridors have been finalised DB now says it cannot confirm how much it will invest next year and beyond.

“What is clear, however, is that the current funding sources are designed for conventional infrastructure management,” DB says. “If we replace [old infrastructure] earlier and increase performance in the process, we will probably need more funds in the short term. At the same time, however, bundling and bringing forward planned construction projects will create synergy effects that will enable us to limit additional costs. In any case, we assume that the benefits are significantly greater than possible additional costs.”

While the busiest corridors will see a step change in reliability, operating flexibility, and capacity, it is unclear what lies ahead for busy regional lines where traffic has increased thanks to the letting of operating contracts which often call for an increase in train frequency. Regional passenger associations and pressure groups have been calling for greater investment in these lines as well to remove bottlenecks and improve reliability.

The federal government, which came to power in November 2021, gave a commitment to increasing the electrified network from 60% today to 75% to help meet climate change objectives.

Deutschland Takt

Creation of a national regular interval timetable - the Deutschland Takt project - was also seen as central to the government’s plans to double passenger numbers by 2030 and increase rail freight’s market share to 25%. However, Mr Hans Leister, chairman of both the Pro-Rail Alliance and the Deutschland Takt Coordination Group within the Ministry of Transport, says the project is at a standstill and wrote an open letter to Wissing in June to point this out.

“The 181 infrastructure measures derived from the 2030 target timetable of the Deutschland Takt are all on hold,” Leister says. “Not a single project has been substantiated by the ministry in such a way that implementation can begin.

“There’s no more money for rail than for road in this budget year, nor is there funding security for Deutschland Takt’s infrastructure measures in this or next year’s budget. What we finally need from the federal minister of transport are reliable plans and timetables.”

There is also a feeling amongst some private operators and pressure groups that nothing much will change unless DB Network is separated out of DB to become an independent infrastructure manager focused on the needs of all of its customers. There are also calls to reduce track access charges to make the rail network more competitive, although this would require even greater financial support from the federal government. Lutz argues that fixing the infrastructure must come ahead of cutting access charges.

Technology might be able to solve some of the infrastructure challenges ahead. For example, DB plans to use AI in the future to enable it to plan capacity more intelligently before the trains start to move. DB believes the use of algorithms and data will allow it to improve the efficiency of timetable and construction site planning.

“With AI, we will therefore be able to run more trains and more punctually on the entire network in the future,” DB told IRJ.

Installing the latest version of ETCS and switching to the new Future Rail Mobile Communication System (FRMCS) when it becomes available, could help to increase capacity for a relatively small outlay, but DB needs to get its ETCS programme back on track. In any event, a lot more money will need to be invested in the network if DB is going to solve its current capacity and reliability problems, let alone provide capacity to meet the climate change targets.