ELECTRIFICATION in Britain has had a turbulent history over the past decade or so. The British government outlined an ambitious £1.1bn electrification programme in July 2009, which included the electrification of the Great Western Main Line (GWML) between London, Reading, Oxford, Newbury, Bristol, Cardiff and Swansea, to be completed within eight years. In parallel, planning was due to begin immediately for the electrification of the Liverpool - Manchester line, to be completed within four years.

In announcing the programme, the then secretary of state for transport, Mr Andrew Adonis, described the GWML as “the longest non-electrified inter-city route in Britain, of vital national strategic importance to both England and Wales.” Electrification was due to enable the introduction of a predominantly electric train fleet, which would in turn offer faster journey times, more seats, greater reliability, improved air quality and lower carbon emissions than their diesel equivalents, as well as being cheaper to buy, operate and maintain.

Fast-forward 11 years, and the project has become an example of how not to manage an electrification project, with the budget increasing from £874m in 2013 to £2.8bn in 2015, making it around seven times more expensive than electrifying the East Coast route which was completed in 1991 - Britain’s last major electrification scheme. The project also faced major delays, with the electrification of the Severn Tunnel in June marking the final step of the truncated project enabling direct London Paddington - Cardiff Central electric services to operate for the first time.

The cost explosion on the GWML had a major impact on electrification schemes across Britain. Previous transport secretary, Mr Chris Grayling, announced the cancellation of three major rail electrification projects in the North, the Midlands and Wales in July 2017, affecting routes between Kettering and Sheffield, Windermere and Oxenholme, and Cardiff and Swansea. GWML electrification from Didcot Parkway to Oxford, branches to Henley and Windsor, Chippenham - Bath Spa - Bristol Temple Meads, and Bristol Parkway - Bristol Temple Meads was also deferred indefinitely by the government in November 2016.

This pause could soon be lifted though, with infrastructure manager Network Rail (NR) releasing its Traction Decarbonisation Network Strategy (TDNS) interim programme business case on September 10.

The plan was developed in response to the government’s commitment to achieve net zero greenhouse gas emissions by 2050, which prompted the Department for Transport (DfT) to ask the rail industry to explore whether it would be possible to remove all diesel-only trains from the network by 2040 in England and Wales. The Scottish government has set a more ambitious target to decarbonise domestic passenger rail services by 2035.

The TDNS interim programme business case includes in-depth studies of the strategic and economic cases for the strategy, and also gives an overview of the work underway on the commercial, financial and management cases that will be released in the full programme business case later this year. The TDNS will then feed into the Transport Decarbonisation Plan (TDP), which is being prepared by the DfT as the main policy document governing transport decarbonisation in Britain.

The TDP will consider policies to sustain decarbonisation through modal shift, and NR says it is expected that rail will represent the main public transport system capable of attracting private vehicle trips, especially for medium and long-distance journeys.

“The railways in Great Britain play a critical role in supporting the economy and connectivity between communities across Britain,” NR managing director - system operator, Mr Paul McMahon, says in the TDNS foreword. “Rail is a relatively environmentally friendly mode of transport, but we need to do more, and we need to be part of the solution to the climate change challenge.

“The work to end greenhouse gas emissions will require a commitment to a long-term, stable and efficient programme of works which will last at least the next 30 years. In order to meet the British government’s commitment to achieve net zero by 2050, and any interim emissions targets along the way, we need to set the wheels in motion.”

“We need to do more, and we need to be part of the solution to the climate challenge.”

Paul McMahon, NR managing director - system operator

The Rail Industry Decarbonisation Taskforce identified three possible traction technologies which are sufficiently mature to replace diesel: electric, battery and hydrogen.

Each of these modes comes with a trade-off, be it price, speed or power capability. Battery and hydrogen technologies are unsuitable for long distance, 200km/h operation and freight services as these have higher energy needs. Electric traction is incredibly versatile in that it can successfully provide energy for all types of journeys, but it relies on fixed infrastructure that has a relatively high capital cost compared with battery and hydrogen technology.

Using these technical and cost implications, NR studied every section of unelectrified line in the country to see where each solution can be most effectively used. Of the 15,400 track-km of unelectrified line in Britain, NR found it will need to provide 11,700 track-km of electrification, 400 track-km of battery operation, and 900 track-km of hydrogen operation.

NR found that electrification may also represent the most sensible option for some areas of the network which are particularly busy, even though it would be technically possible to use battery and hydrogen. These areas of the network are identified as ‘multiple options’ where further economic and operational analysis is needed before the best choice of technology is decided.

Of the 2300 track-km where multiple options could be delivered, operational and economic analysis has identified a further 1340 track-km of electrification, battery operation over 400 track-km and hydrogen operation over 400 track-km. Further work at a local level is needed for the remaining 260 track-km where no clear decision has yet been made.

Adopting these plans would result in 96% of passenger-km operated using electric traction, with the remaining 4% operated using hydrogen and battery units. Around 90% of freight-km could be operated by electric trains with the remaining 10% requiring either diesel or alternative traction locomotives. Modelling suggests this residual emission from diesel operation would be around 50 million kg carbon dioxide equivalent (CO2e) per year, around 3% of current traction emissions. This would either need to be offset or removed using alternatively fuelled freight locomotives, which are not currently available in Britain.

While the electrification outlined within the strategy is extensive, the recommendations do not indicate which sections should take priority, instead representing the end goal required to decarbonise rail traction. The TDNS says the delivery of electrification could extend beyond 2050 in order to maximise efficiency and minimise disruption to the network, and interim solutions could be required for some areas.

Costs

The TDNS identified a number of benefits resulting from the proposals, including carbon reduction, road decongestion and improvements to journey times, performance, and passenger revenue. These were weighed against the costs, including infrastructure capital and renewal, infrastructure maintenance, disruption during construction, and rolling stock maintenance, fuel and leasing.

The capital costs of electrification was estimated using a wide total cost bracket spanning from £1m per track-km to £2.5m per track-km at 2020 prices, with these costs based on historical project outturn costs rather than estimates. In total, the TDNS identified 4650 track-km that could be electrified at £1m - £1.5m per track-km; 5358 track-km to be electrified at £1.5m - £2m per track-km; and 3122 track-km that could be electrified at £2m - £2.5m per track-km.

The capital costs of battery charging points and hydrogen refuelling locations were determined using preliminary estimates from RSSB’s T1199 project.

Implementing the TDNS as proposed would incur infrastructure capital costs of between £18bn and £26bn at 2020 prices. This would result in a median capital spend per year of 18-54% of the enhancement budget allocated in Control Period 6 (CP6) for 2019 to 2024, the five-year budget periods through which NR is funded. Rolling stock costs are expected to be between £15bn and £17bn for passenger trains and a further £3bn - £4bn for freight trains, resulting in a combined capital cost of between £36bn and £47bn. Analysis suggests that between 3600 and 3800 electric and between 150 and 200 battery and hydrogen passenger cars will be required for the fully decarbonised network.

Adopting these plans would result in 96% of passenger-km operated using electric traction, with the remaining 4% operated using hydrogen and battery units.

TDNS is expected to provide £12bn - £17bn in cost savings for passenger operation compared with continued diesel operation, with further cost savings envisaged for private freight operators.

The analysis found that the implementation strategies which provided higher emissions reductions delivered over a longer period provide a good balance of value for money and affordability. Ultimately, the economic analysis found that rail decarbonisation can generate a return in value within 90 years from 2020, subject to the speed of capital investment, scope of decarbonisation, and how cost estimates for decarbonisation mature over time. This return on investment will be generated through operating cost savings, lower greenhouse gas emissions, and increased revenue, either direct or through corporation tax.

One of the major stumbling blocks for electrification projects over the last few years has been the poor management of the GWML project, while the way in which the costs ballooned over such a short period of time is seen as one of the reasons other major electrification projects were put on hold.

However, the industry is keen to stress that this project was more of an anomaly than the norm. In March 2019, Britain’s Rail Industry Association (RIA) released its Electrification Cost Challenge, which found the cost of delivering main line electrification projects in Britain could be reduced by 33-50%.

The study suggests that cost increases in projects such as Great Western Electrification Programme (GWEP) were the product of “an unrealistic programme of work, unpreparedness in using novel technologies resulting in poor productivity, and a ‘feast and famine’ electrification policy.”

An analysis of 20 electrification projects in Britain and mainland Europe found almost half of projects achieved a cost ranging from £750,000 to £1m per track-km. The analysis showed five projects which experienced complications in delivery, including London’s Gospel Oak - Barking line and the Edinburgh - Glasgow Improvement Programme (EGIP), were completed at a cost of £1.5-£2m per track-km. Of the remaining British projects, the Barnt Green - Bromsgrove, Walsall - Rugeley, GWEP and Midland Main Line schemes all fell within the £2-2.5m range.

RIA concluded that ‘simpler’ electrification projects should be delivered within the £750,000- £1m track-km range, with more complex projects achieving £1m-£1.5m per track-km.

The report outlines a range of options for reducing structural clearance works, which represent as much as 30-40% of the cost of some recent projects.

This work to reduce structural cost has continued, with NR awarding Atkins a 10-month contract in August to develop new overhead electrification (OHE) design rules, with the intention of reducing the cost of future electrification projects.

Atkins, a SNC-Lavalin company, will use digital image correlation (DIC) technology to analyse the relationship between the type of overhead electrification and pantographs used, and train speeds and contact wire uplift.

DIC is a measurement technique where photographs, taken in rapid sequence, are used to track and record the motion of a deforming solid, such as a moving overhead cable.

Measurements and data collection will be carried out by the Atkins DIC team, which specialises in non-contact measurements in a live rail environment, and which can measure structural deflections to an accuracy of 0.05mm. Atkins will then develop rules to enable smaller uplifts to be used in future schemes.

The new rules are intended to allow for significant reductions in required cable uplift, and will be used by NR on future electrification projects to reduce or potentially eliminate the need for costly infrastructure changes such as bridge reconstruction and track lowering.

Implementation

Providing the funding and political support is available, the next step in implementing the plan depends on securing a skilled workforce to implement it. This has been one of the major reasons for consistent calls from industry for a rolling programme of electrification. They argue that the boom and bust cycle can often lead to competencies developed during the boom cycle being lost to other industries during the bust.

The TDNS says NR is aware of the issue, and recognises that a rolling programme of electrification would ensure that training the required workforce would be cost-effective.

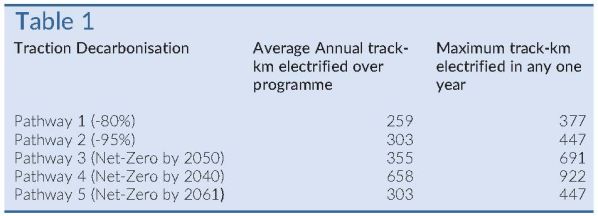

Five pathways were identified, ranging from a decarbonisation strategy that achieves an 80% reduction in traction power carbon emissions from 2019 levels, through to a decarbonisation strategy that achieves net-zero carbon emissions from 2019 levels by 2040. NR also calculated the net present value for a “do-minimum” pathway, with no changes to the current status of the railway except for the operational impact of the post HS2 Phase 2b timetable change on the conventional network.

NR calculated the rate of electrification required annually for each of the five pathways (Table 1), which ranges from an average of 259 track-km annually, with a peak of up to 377 track-km annually, for Pathway 1 resulting in an 80% reduction in emissions. This compares with Pathway 4, which calls for net-zero by 2040. This would require electrifying 658 track-km annually, with a peak of 922 track-km.

Previous major electrification programmes such as East Coast electrification in the late 1980s and the more recent CP5 electrification schemes saw an annual average delivery rate of between 300 to 450 track-km. To achieve this again, NR has proposed developing delivery teams that could deliver the continual programme of electrification, with each team delivering 75 to 100 track-km a year.

Recommendations

The plan only covers the existing network, but a fund announced in the 2020 budget in March was identified to support the reversal of the Beeching closures which occurred during the 1960s and 70s. A number of proposed schemes are now emerging which both utilise existing freight only parts of the network or propose extensions beyond the current network. The TDNS says it is critical that these plans support zero-carbon operation using zero carbon rolling stock such as electric, battery or hydrogen in conjunction with the wider network to which it is linked.

While the plan envisages the eventual removal of all diesel trains from the network by 2050, it does acknowledge that they have a major role to play in the interim.

“Hybridisation and the use of multi-mode trains offer an excellent opportunity to progressively realise both emissions reduction and the benefits of electrification and as such, whilst not an optimum long-term solution, should be considered in conjunction with the programme of electrification projects,” the strategy says.

These diesel trains would be more effective when reconfigurable to become bi-mode and, eventually, fully electric or alternative traction vehicles.

“Ultimately diesel cannot play any part in a zero-carbon railway and procurement of new diesel-only trains is likely to carry a significant volume of risk that they will be made redundant beyond 2050,” the strategy warns. “Procurement of diesel-only units should only be pursued where there is a clear strategic and economic rationale for doing so.”

Conversely, battery and hydrogen trains will play a key long-term roll in the decarbonisation of the network, and the strategy encourages the quick introduction of these modes in order to enable the development of new standards, operating procedures and products required. While the required rolling stock is already developed, the wider operational knowledge is required to inform the successful wider deployment of these technologies.

The TDNS outlines the biggest programmes of electrification in Britain in recent history, and would provide a step change in infrastructure quality. It is now up to the government to follow through with its commitments to reducing greenhouse gas emissions by putting the necessary financial support behind the plan to develop a zero-carbon network that will provide benefits for generations to come.