A German-based company is looking to launch a service which it says solves two of the major issues faced by multi-modal operators: carrying a wide range of semi-trailers and reliable delivery.

As the European Union looks to transfer more freight from road to rail and waterways, Frankfurt-based operator Helrom is due to launch a freight service at the end of April operating six days a week between the port of Duisport in Duisburg, Germany, and Vienna, Austria, using Megaswing wagons capable of carrying all types of lorry semi-trailers.

Transporting semi-trailers by rail is a difficult task, which often requires specially-designed lorries that can be craned onto the train, or carrying the tractor unit along with the trailer.

The Megaswing wagons were developed by Kockums Industries in Sweden in the early 2000s, but were not readily adopted by operators, partially due to the economic downturn in 2008 and 2009 which saw large numbers of wagons sitting idle across the continent as freight numbers dropped.

The Megaswing product and patents were acquired by Helrom in 2019, and the operator now has a fleet of 18 wagons on order that it will use on the route.

“You have a fixed timetable which is always the same over the years and you stick to that timetable under any circumstances,”

Mr Roman Noack, CEO, Helrom

The company, headed by CEO, Mr Roman Noack, and chairman, Mr Keith Heller, was launched in 2017. Noack first began working in the freight market in Germany, including 10 years working for German Rail (DB), while Heller was the head of British rail freight operator EWS - which was acquired by DB Cargo in 2005 - between 2004 and 2011.

The Duisport - Vienna service, consisting of 20 wagons carrying up to 40 semitrailers, will depart at 22.00 with a transit time of 19 hours. Noack says this has been calculated to allow enough leeway for unforeseen events to ensure the service always arrives on time. “You have a fixed timetable which is always the same over the years and you stick to that timetable under any circumstances,” he says.

Helrom will lease or rent the locomotives needed for the service, supplying the drivers itself. The company will also maintain the wagons in-house.

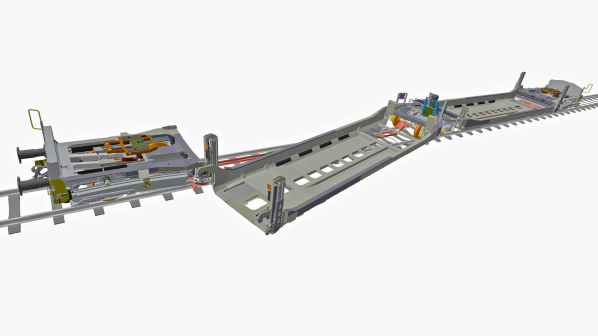

Loading and unloading the Megaswing wagons does not require any additional infrastructure such as a loading ramp, apart from a large paved surface and a generator. To load the wagon, hydraulic supports are lowered for stability, before the base is swung to the left or right. The semi-trailer is then backed onto the platform, before swivelling back onto the wagon and lowered slightly to lock it into place. The supports are then raised, with the operation taking around three minutes to complete.

Around €10m has so far been invested in the project, with the capital coming from a number of countries including the United States. Helrom says it has also adopted “American-style” business principles to ensure the freight train runs strictly according to schedule.

“You have a fixed timetable which is always the same over the years and you stick to that timetable under any circumstances,”

Roman Noack

While the Megaswing previously had trouble with adoption into normal traffic, Noack says he is convinced that now is the right time to introduce a service.

Rail’s share of freight in Germany is currently around 17%, but the federal government has set a goal to increase this to 26%. The European Union is also aiming to speed up the process of shifting a “significant amount” of the 75% of freight carried by road to rail and waterways.

The Duisburg - Vienna service will be the start of a European-wide network, with Helrom identifying 50 corridors to introduce the service by 2026.

This network would extend from Stockholm in the north to Rotterdam in the west, Perpignan in the south and the Bulgarian-Turkish border in the east.

Around three quarters of freight in Europe is currently transported by road, with around 78% of this in non-craneable trailers which cannot be loaded onto rail wagons. Almost a quarter of these lorries travel more than 500km across Europe, and Noack says capturing even a small percentage of this market would allow Helrom to ensure “enormous growth.”