HISTORY was made on June 14 2019. Rio Tinto completed the transition to entirely automated operation of its 1500km railway in the Pilbara region of Western Australia, becoming the first heavy-haul railway in the world to operate an automated network.

Described by Rio Tinto as the world’s largest robot, AutoHaul is operating up to 50 automated and unmanned trains at any one time. Each 240-wagon, 2.4km-long consist, requires two to three locomotives, which haul 28,000 tonnes of iron-ore from the company’s 16 mines to the ports of Dampier and Cape Lambert on an average 800km, 40-hour journey.

Removing the two to three driver shift changes has also cut an hour from the average journey

Manned operation remains for last mile at the ports, with drivers joining the trains at the end of the main line. Loading and unloading of product from the wagons is also a completely automated process.

Rio Tinto says AutoHaul has already helped to increase average speeds by 5-6%, and the company is optimistic that this can improve further. Removing the two to three driver shift changes has also cut an hour from the average journey, while the section run time variation between AutoHaul services is just 15-30 seconds compared with 2.5-5 minutes when the trains were manned. This is helping the operator to plan more efficient train schedules, reduce bottlenecks and boost productivity.

AutoHaul is clearly an incredible achievement. And it rightfully received significant attention during the recent International Heavy Haul Association (IHHA) conference in Narvik, Norway.

The mining company has been tight-lipped about the project throughout its development. As a privately-listed company, it was mindful of stock price fluctuations that might result from too much information about the controversial and pioneering project entering the public sphere. Indeed, the complexity of the project resulted in substantial delays and cost overruns.

While initially cited as costing $US 518m at its official launch in 2012, Rio Tinto’s investment soared to $US 940m by 2018, according to figures from the company’s official results, 80% above the initial budget. The full deployment of 100% automatically operated trains in June 2019 was also four years later than planned.

“It has taken a decade or more to get to this point.”

Shaun Robertson, Rio Tinto.

Coinciding with this and the conclusion of the project, Rio Tinto spoke with IRJ about AutoHaul for the first time.

“It has taken a decade or more to get to this point,” says Mr Shaun Robertson, principal advisor for rail at Rio Tinto. “We have been at the forefront of new developments in railway technology in the Pilbara since we began in 1966, whether this was using concrete sleepers or track circuits in the 1990s. This was the foundation for the transition to automated trains. ATP allowed us to shift from two drivers to one, so the next challenge was to move to zero.”

By 2006-2007, Rio Tinto was ready for its first semi-autonomous run. Trial operation using its legacy signalling system in cooperation with Hitachi Rail STS (formerly Ansaldo STS) took place on a low-volume, low-traffic section in 2007 to test the validity of the system.

The system was based on an onboard unit. However, further progress was curtailed by the global financial crisis in 2008. With time to reflect, Robertson says the project was restarted in 2010 with a new strategy, which emphasised developing a system-wide approach.

“Operating an unmanned train with no driver required a fundamental change in our operations strategy and approach.”

The main discussion point, and an early decision in the process, concerned whether to continue to use the network’s existing signalling system as the foundation of automated operation. In particular, there were questions of whether the train control system could support the required information transmission and what would happen in the event of a communication problem.

“Operating an unmanned train with no driver required a fundamental change in our operations strategy and approach,” Robertson says. “For example, if we identify track defects or geometry issues, we will issue a speed restriction for the location. When the trains are manned this process was managed verbally between the driver and the controllers. But when the train control is located in Perth and we have to implement speed restrictions with unmanned operation, we found that we couldn’t manage this additional information with the traditional track circuit system so had to move to communication-based train control via data radio direct to the loco to enable it. This is fundamentally different.”

The AutoHaul system is equivalent to ERTMS Level 2 and has been installed by Hitachi Rail STS under a contract awarded in 2012 as part of the Rio Tinto Iron Ore-Ansaldo STS Framework Agreement established in 2010.

Hitachi Rail STS developed and delivered an automated train management system including a centralised vital safety server (VSS), which is essentially a radio block centre (RBC), the wayside element of the application, and supports the safe and flexible management of train movements. The supplier also delivered upgrades to locomotive control systems to support the deployment of electronically-controlled pneumatic (ECP) braking, overseeing installation and system integration of ECP braking on Rio Tinto’s 200-strong locomotive fleet. In addition, the locomotives are fitted with collision detection systems; automatic train protection (ATP) technology, which controls train speed and adheres to speed limits; and an onboard video camera to record the forward view of the train.

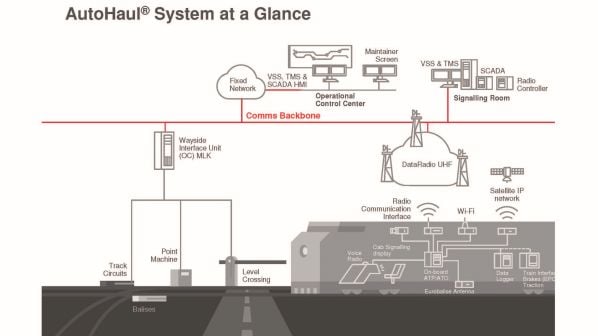

Figure 1 shows a schematic diagram of the AutoHaul system, which was presented at IHHA by Mr Leone Fenzi, head of the business management office and customer relationships for Americas and Asia-Pacific at Hitachi Rail STS.

Differences

Fenzi says there are a couple of fundamental differences between a conventional ERTMS Level 2 application and the AutoHaul project. Firstly, the system does not use GSM-R for train-to-ground communication. Fenzi says that because the application is taking place outside Europe, the supplier was not obliged to follow this protocol. Rio Tinto also requested that the system use the railway’s existing data/UHF radio network, which is supported by 60 base stations located across the network, and was upgraded to meet the demands of the new system. Extensive testing in instances of high traffic was conducted to ensure reliability with multiple layers available in case the system falls out. These consist of a back-up fibre optic network and a satellite-based system, which is able to provide seamless and continuous communication to the trains.

The ATP system itself uses an interlocking which sets the route according to the commands received by the train control system. The VSS receives the route from the interlocking and transmits this to the onboard unit, providing the movement authority, which follows the distance-left-to-run principle. Like an ETCS application, the system uses a network of balises for group referencing and to run the trackside elements. However, there are what Fenzi describes as several peculiarities. Most notably is the presence of integrated asset protection across the entire system, which can automatically trigger a change to the limit of authority for the train according to an alarm generated on the wayside due, for example, to an issue at one of the network’s 42 level crossings. This process occurs through the same chain: through the VSS and via the radio to the onboard unit.

The ATO element relies on two separate channels - one from the control centre and the other from the onboard unit, which are linked together and communicate with one another.

First, the ATO system gathers the information from the ATP system on the current journey, the speed and location of the train, from which the system performs its own calculation for operation. These calculations are also informed by information from the other channel from the control centre.

Unlike the ATP data, this information is not safety-related but necessary for the journey itself. This includes the schedule as defined by the operator and the information required for the driving strategy, a sub element of the ATO, which includes the track map, a database of the entire network and the algorithm which enters and monitors the train’s journey while it is in service. Connected to this is data for external elements essential for operation such as the throttle, brakes, horns, locomotive information and data loggers.

“All the actions that the driver would make now have to be performed by the system and/or the rolling stock asset evaluator which sits in the control centre and basically monitors all of the trains and locomotives,” Fenzi says. “They make decisions that a driver would do if sitting in a cab. There are some critical actions taken by the system whereas others are monitored remotely by the controller who can decide to act immediately or later on.”

Fenzi says Hitachi Rail STS used legacy systems where possible to develop this system architecture. In addition to the radio network, this includes the onboard train controller module supplied by Wabtec, and the existing ATP infrastructure installed by Hitachi Rail STS during the 1990s. This is equivalent to an ETCS Level 1 application and was upgraded to meet the needs of the new system with modifications carried out to the trackside element.

Special attention was paid to the network’s level crossings as the greatest area of risk with the public when developing the AutoHaul system. These are fitted with lighting, CCTV and a laser-based obstacle detection system which is connected to the ATP. The 4K HD cameras provide a clear view of the crossing, far superior to the driver’s line-of-sight perspective.

First-of-a-kind

Fenzi says Hitachi Rail STS was already working on introducing ATO over ETCS long before there was even talk of developing a specification for Grade of Automation (GoA) 4. This was not included in the most recent Command and Control and Signalling TSI (CCS TSI) issued in 2016 with Europe’s Shift2Rail project currently in the process of developing and validating a standard ATO system up to GoA 3/4 over ETCS. This is not expected until the next CCS TSI revision in 2022.

“We needed a partner which had already worked in this environment and with GE locomotives in order to get the best expertise possible for this specific case and environment.”

Leone Fenzi, Hitachi Rail STS.

As a first-of-a-kind system and with no formal standard available, Hitachi Rail STS inevitably drew on its experience of developing GoA4 for metro networks for the AutoHaul project. However, Fenzi says to be successful, the company decided that it required a specialist partner familiar with freight applications. An agreement was subsequently reached with New York Air Brake (part of the Knorr-Bremse group) to develop an algorithm specifically for the freight environment that could handle the particular facets of these operations - for instance, high drawbar forces.

“We needed a partner which had already worked in this environment and with GE locomotives in order to get the best expertise possible for this specific case and environment,” Fenzi says. “It also enabled us to focus on what is our major capability - system integration.”

Wayside installation was completed in 2014 with testing taking place in 2015 and 2016. The new signalling system was completed in 2016-17 at which point testing of different driving strategies began.

Fenzi says this was a four-stage process, which effectively developed four modes of operation.

The first stage was the rollout of the ATP system as a vital safety system covering the entire network, providing the framework for the subsequent deployment of ATO. In the second phase, the driver remained in charge of driving, accelerating, braking and coasting the train. However, the ATO system was connected to the Driver Machine Interface (DMI), with the algorithm suggesting the optimal driving profile according to the predetermined driving strategy. In the third and fourth stages, the ATO was connected to the throttle and the brake, and all of the locomotives interfaces, so for the first time the system was able to autonomously drive the train. In the third mode, the driver remained in the cab in a supervisory capacity. In the fourth stage, drivers were removed.

“Attended mode became an important part of the acceptance process and although it lasted a little longer than expected, it was essential to boost confidence in the system among all parties involved,” Fenzi says. “We effectively had someone sitting there ready to intervene but they never did because the system did what it was supposed to do, to the point where everyone had the confidence to remove the person from the cab.”

Robertson says many iterations of the driving strategy were tested in order to retune the system to maximise operating efficiency. AutoHaul received regulatory approval in May 2018 following the successful completion of “many thousands of kilometres” of tests. The very first unmanned loaded train was operated on July 10 2018, running 280km from Tom Price mine to Cape Lambert. Driverless operation was gradually increased over the next few months, reaching 34 trains per day and 45% of daily kilometres operated by October. This had risen to more than 90% of trains operated by February.

The development of AutoHaul coincided with a 30% expansion of Rio Tinto’s fleet and the opening of a new port with 120 million tonnes of annual capacity. Overall network capacity increased from 230 million tonnes to 330 million tonnes. With significant construction work taking place alongside AutoHaul testing, Robertson says this posed a challenge to managing everyday operations and the improvement works.

While drivers are now absent from the trains, some are located at strategic locations across the network in case of a problem with the unmanned trains. Manual driving also still takes place in the event of recoveries. However, removing the drivers has helped to deliver some of the project’s most notable enhancements in performance, notably improvements in locomotive fuel efficiency and reduced wear-and-tear on the track and the locomotives. The need for 1.5 million-km of annual road movements to transport drivers to and from trains mid-journey has also been cut.

Next step

And this is just the start of what is possible. Fenzi says that under the terms of the agreement, Hitachi and Rio Tinto will continue to work together to further optimise the system. “The next step is to continue improving the algorithm, maybe thinking about a new strategy for optimising the driving of the train,” he says. “For example, to minimise braking when two trains meet at a passing loop. We are not standing still enjoying what we have achieved but are continuing to think about how to improve what we have.”

With Rio Tinto’s application now up and running, and the miner already reaping the benefits, attention is inevitably shifting to what is next.

Robertson says Rio Tinto is in an advantageous position compared with other railways looking at AutoHaul and the potential difficulty of rolling out similar projects on more complex networks. “The big reason we could do it is that we have a closed private network,” Robertson says. “There is no other railway traffic. It is our trains, train control system, traction system, track infrastructure, mines and ports. Also, the Pilbara is an arid desert, with minimal interaction with people and the rail network.”

Yet this isn’t putting people off. Other Australian railways are developing similar projects and there is strong interest from across the world. In particular, Fenzi says North American Class 1s have consulted with both Hitachi Rail STS and Rio Tinto to learn about what they have achieved in the Pilbara as they look to adapt the technology to their own circumstances.

“The Class 1s are the natural terrain to export such a technology,” Fenzi says. “Of course, tweaks will be needed but the concept is very similar. We have the network owned by a private operator, we have those freight peculiarities and they, like Rio Tinto, also have the mindset to unlock the benefits.”

As well as making history, AutoHaul looks set to become the pioneer for future autonomous and unmanned railway operation around the world. It is now no longer a question of if, but when the next project comes online.