STADLER credits its “innovative products” for the company’s “robust operating performance in a challenging global environment” in 2023.

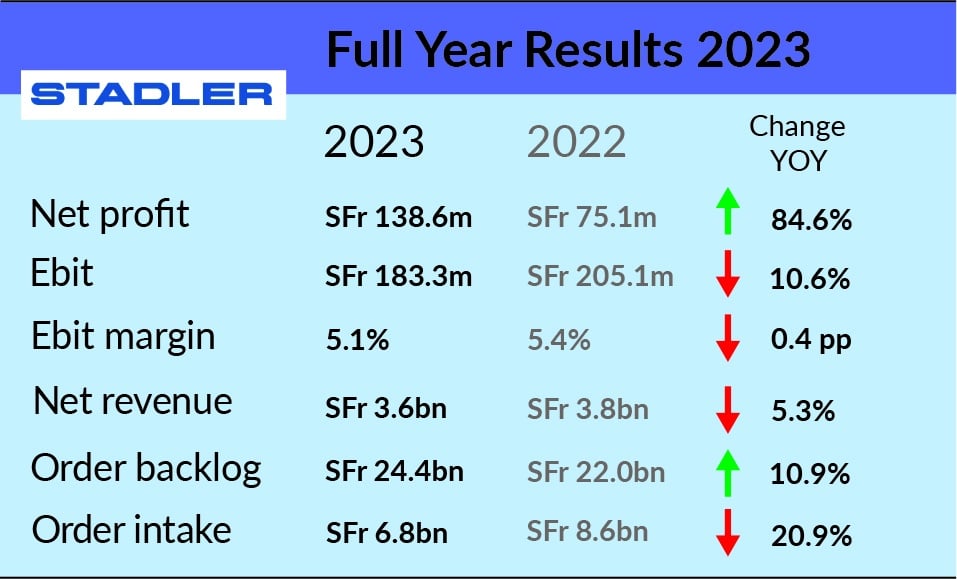

The Swiss manufacturer’s order backlog of SFr 24.4bn ($US 27.7bn) was nearly 11% up on the previous year’s figure of SFr 22.0bn.

The rise in the backlog came despite a fall in order intake for 2023 and notable deals for rolling stock in a diverse range of geographic markets, including Kazakhstan, Lithuania, Italy and the United States. The order intake dropped by nearly 21% to SFr 6.8bn from SFr 8.6bn in 2022.

Also down on the previous year were Ebit and net revenue, by 10.6% and 5.3% respectively. Ebit was SFr 183.3m compared with SFr 205.1m in 2022 and net revenue in 2023 was SFr 3.6bn compared with SFr 3.8bn the year before. The Ebit margin slipped 0.4 percentage points to 5.1%.

The company attributes the strong appreciation of the Swiss franc, particularly against the Euro, to these falls. It cites negative currency effects of around SFr 25m, mainly from orders processed in Switzerland and invoiced in foreign currencies.

Nevertheless, net profit soared by nearly 85% on the previous year in 2023, reaching SFr 138.6m, up from SFr 75.1m. Stadler says a combination of reduced currency losses which were SFr 11.4m in 2023 compared with SFr 56.7m in 2022, and significantly higher interest income due to a high level of liquidity, helped deliver this positive outcome.

Outlook

Stadler uses what it describes as the conservative units-of-delivery accounting method in its rolling stock division, which means that new rail vehicles must generally be completed and accepted by the customer before corresponding sales and earnings can be recognised.

A high order intake in recent years means that gross output should increase substantially from this year onwards, with a corresponding upswing in sales and earnings, particularly in the 2026 financial year.

Stadler therefore expects revenue of up to SFr 5.5bn in the 2026 financial year and an Ebit margin of 7-8%. It says it remains convinced that a margin of 8-9% can be achieved in the medium term under normal economic conditions.

For detailed data on fleet orders from around the world, subscribe to IRJ Pro.