THE East African Community (EAC) has devised a series of multimodal transport corridors intended to improve connectivity across the region’s six partner states, stretching from South Sudan in the north to Uganda and Kenya, Rwanda and Burundi in the west and Tanzania in the south.

Among these are Central and Northern corridors, which will include the construction of a new modern standard-gauge railway (SGR) network that will improve cross-border and intra-country connectivity.

The importance of harmonising technical standards for interoperability in the various corridor projects came to light during the review of the specifications for the proposed African high-speed rail network. Discrepancies were found in the SGRs currently under construction for the Northern and Central corridors, which could lead to potential integration challenges in future projects.

The EAC has obtained funding from the African Development Bank and is currently recruiting a technical railway expert whose work will centre on creating an efficient rail system that incorporates both long-term plans and immediate measures aligned with the EAC Vision 2050.

One of the first tasks for this expert, who is expected to be appointed this month, will be to update the EAC’s Railway Masterplan, which was published in 2010. Its findings were reinforced in the Railway Enhancement Study financed by the African Development Bank and published in 2016.

These studies concentrated primarily on the 1000mm and 1067mm-gauge networks. But with the emergence of standard gauge in Kenya, Tanzania and Ethiopia, the masterplan now requires an update.

Among the other areas in need of attention is skills. The Railway Task Force, composed of member states’ representatives, holds annual meetings to discuss regional railway issues and has identified a crucial need to establish centres of railway excellence in Africa. Existing institutions, such as the Kenya Railways’ Railway Training Institute in Nairobi, are being evaluated for potential development to form such a centre that will help to build capacity in critical skills and support technological advancement.

The following is a progress update on the prospective SGR projects in East Africa.

Kenya

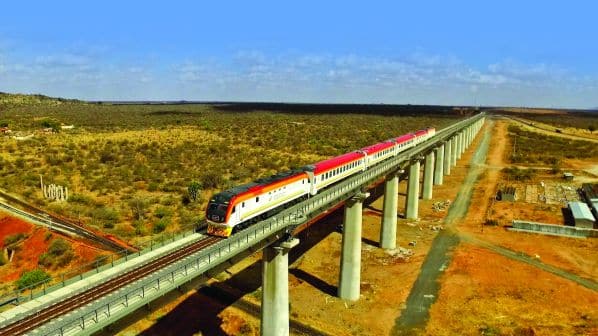

THE 472km first phase of the SGR Northern Corridor from Mombasa to Nairobi entered service in 2017. It was followed by the 120km Nairobi - Naivasha SGR Phase 2A, which was completed in 2019, and was built by China for an estimated cost of $US 3.75bn, although the Kenyan government has sought to renegotiate the terms of the loan for the project.

Despite these difficulties, the country is pursuing SGR expansion, unveiling an ambitious Shillings 2.1 trillion ($US 15.15bn) plan to build another 2746km of SGR in May. Several projects are already at the feasibility stage. These include Phase 2B, which involves extending the existing line by 262km from Naivasha to Kisumu, and Phase 2C, which will run for 107km from Kisumu to the Ugandan border town of Malaba and was planned under the original Chinese-backed SGR project. These extensions are expected to cost Shillings 380bn and Shillings 122.9bn respectively and the enhanced port at Kisumu will serve freight traffic on Lake Victoria.

The plans also include extending the SGR network by 325.3km from Mariakani to Lamu Port at a cost of Shillings 257.3bn and a further 544.4km to Isiolo at cost of Shillings 348.7bn as part of the wider Lamu Port-South Sudan-Ethiopia Project (Lapsset). This multimodal scheme aims to open up northern Kenya to economic development and revamp the northern corridor by improving transport connections within Kenya, South Sudan and Ethiopia. Delivery of the railway elements is envisaged by the end of June 2027.

External financiers will cover the bulk of the project’s costs with the Kenyan government expected to pick up the remainder.

Further projects include the 753.2km section from Isiolo to Nakodok, a town close to the border with South Sudan, which is the single longest stretch and is estimated to cost Shillings 443.2bn. A 475.9km line from Isiolo to Moyale on the border with Ethiopia is planned at an expected cost of Shillings 257.3bn along with a 278km line from Isiolo to Nairobi. This is estimated to cost Shillings 239.2bn.

Tanzania

TANZANIA, considered part of the Central Corridor, is investing heavily in developing its SGR network, with different projects at various stages of execution - some currently in construction and others at the construction feasibility or seeking financing stage.

Tanzania’s SGR network is being built to standards developed by the American Railway Engineering and Maintenance-of-Way Association (Arema) and the International Union of Railways (UIC). The new lines are designed for maximum speeds of 160km/h for passenger services and 120km/h for freight trains, with signalling and telecommunications to ERTMS Level 2 specifications.

Lot I: Dar es Salaam - Morogoro (300km): construction 98% complete and scheduled for completion in May 2023.

- track length: mainline: 205km, sidings: 95km

- six stations: Dar Es Salaam, Pugu, Soga, Ruvu, Ngerengere, Morogoro

- marshalling yard and workshops: Kwala (Coast)

Lot II: Morogoro - Makutupora (422km): 94% complete by May 2023

- track length: mainline: 336km, sidings: 86km

- seven stations: Manyoni, Itigi, Tura, Malongwe, Goweko, Igalula, Tabora

- marshalling yard and workshops: Ihumwa (Dodoma)

Lot III: Makutupora - Tabora (368km): 7% complete by May 2023.

- track length: mainline: 294km, sidings: 74km

- three stations: Nzubuka, Ipala, Bukene

- marshalling yard and workshops: not defined

Lot IV: Tabora - Isaka (165km): 2.4% complete as of May 2023

- track length: mainline: 130km, sidings: 35km

- seven stations: Manyoni, Itigi, Tura, Malongwe, Goweko, Igalula, Tabora

- marshalling yard and workshops: Fela (Mwanza)

Lot V: Isaka - Mwanza (341km): 31% complete as of May 2023.

- track length: mainline: 249km, sidings: 92km

- 10 stations: Isaka, Luhumbo, Shinyanga, Seke, Malampaka, Bukwimba, Malya, Mantare, Fela, Mwanza Central

- marshalling yard and workshops: Tabora

Phase II planned links include:

- Tabora - Kigoma: mainline: 411km, sidings: 95km, total: 506km. A $US 2.2bn contract for construction of the line was signed with China Civil Engineering Construction in December 2022.

- Uvinza - Musongati - Gitega: mainline: 282km. This is part of the link to Burundi. Procurement of the contractor is underway.

- Kaliua - Mpanda - Karema: mainline: 317km. Feasibility study and preliminary design completed.

- Isaka - Rusumo - Kigali: mainline: 356km. Feasibility study and preliminary design completed.

Future Tanzanian projects

Beyond the primary SGR projects, Tanzania is also planning other new railways. These include:

- Mtwara - Liganga/Mchuchuma Amelia Bay: The more than 1000km line will connect the port of Mtwara with various mining areas in southern Tanzania. The feasibility study and preliminary design have been completed.

- Tanga - Arusha - Musoma: This line will link the port of Tanga with Musoma on Lake Victoria, passing through Arusha. This is expected to boost regional trade, particularly with Uganda.

- Dar es Salaam commuter network and Dodoma commuter network

As part of its railway modernisation efforts, Tanzania has placed several orders for new rolling stock:

electric locomotives: two units have been ordered from Lückemeir Transport and Logistics, Germany - passenger coaches: a total of 30 refurbished double-deck passenger coaches have been ordered from Lückemeir Transport and Logistics with six received so far and the remainder due by the end of this month. These will be used to support testing between Dar es Salaam and Morogoro. A further 59 vehicles are being procured from Sung Shin Rolling Stock Technology (SSRST), Korea

- EMUs: 10 EMUs ordered from Hyundai Rotem

- freight wagons: CRRC is supplying 1430 wagons

- track maintenance equipment: order placed with SSRST of Korea.

Uganda

DESPITE commencing the rehabilitation of the Tororo - Gulu metre-gauge railway line at a cost of Shillings 199.9bn ($US 50m) - a project contracted to China Road and Bridge Corporation in April 2023 - Uganda has not yet started work on any of its SGR projects.

However, significant progress has been made in the planning and preparatory stages. Comprehensive feasibility studies are complete, and land acquisition for the right of way are in progress. The government of Uganda is now actively seeking funding to facilitate construction of the following lines:

- Malaba - Tororo - Gulu - Juba, and

- Malaba - Jinja - Kampala - Kigali/Kasese.

Other projects are in the financing stage.

Democratic Republic of Congo

IN 2017 the Democratic Republic of Congo (DRC) signed an agreement with a Chinese firm to develop multiple SGR lines to serve the provinces of Tshopo, Bas-Uélé, Haut-Uélé, Ituri and Mongala. The feasibility study for these projects began in 2019.

Notably, an invitation to tender for initial works for the design and construction of an electrified SGR under the Multinational Tanzania - Burundi - DRC SGR Project Phase I has been issued. This project involves the construction of a new line from Uvinza to Musongati and Gitega, boosting regional transport connectivity and capacity.

Ethiopia

THE Addis Ababa/Sebeta - Meiso - Dewanle SGR has been fully operational since January 2018 and was built under an engineering, procurement and construction (EPC) model by two Chinese companies: China Railway Group (CREC), which was responsible for 317km and 10 stations, and China Civil Engineering Construction (CCECC), which built 339km and six stations.

The operational performance of the Addis Ababa - Djibouti SGR has shown a significant improvement in passenger and freight volumes since the Covid-19 pandemic.

Under the Growth and Transformation Plan (GTP I&II), Ethiopian Railways (ERC) is planning an ambitious national railway network expansion programme, including increasing the length of the existing 656km SGR network to 3999km within the next decade. This is a slight reduction on the original plan, which envisaged eight routes spanning 5000km radiating from the centre of the country.

The Ministry of Transport is planning four ambitious projects aimed at connecting Ethiopia with its neighbouring ports.

The new network is strategically planned to interconnect economic development corridors, integrate regions with the capital, link potential agricultural, industrial, and mining centres with markets, and provide connectivity with markets and ports in neighbouring countries. This development aligns with several African railway transport masterplans and is part of China’s Belt and Road Initiative (BRI).

Among the most advanced projects is the Awash - Kombolcha - Hara Gebeya/Weldiya line. Being built by Yapi Merkezi of Turkey, this 392km railway is poised to significantly enhance regional connectivity. Despite some delays, the project has made substantial progress, with construction of the first phase nearing completion and work on the second phase now 92.83% complete.

Another ongoing project, the Hara Gebeya/Weldiya - Mekelle railway, is being delivered by the China Communication Construction Company (CCCC). Despite some setbacks, work on this 220km line has reached 57% completion. In addition, work is continuing on providing a new rail connection to the Awash oil depot. China Civil Engineering Construction is responsible for delivering this project, which commenced in 2021.

The Ministry of Transport is planning four ambitious projects aimed at connecting Ethiopia with its neighbouring ports, underscoring the country’s strategic intent to bolster its export capabilities and improve access to international markets.

The first project will run from Weldiya to the Port of Sudan via Werota, Metema and Haiya. This 1512km railway will span two countries, providing Ethiopia with a crucial trade route to the Port of Sudan. A detailed bankable feasibility study, funded by the African Development Bank, has been completed.

The second project is the 1701km Mojo - Bulbula - Shashemene - Hawassa - Sodo - Arbaminch - Konso - Moyale railway, which will connect Ethiopia’s central regions to the Kenyan port of Lamu. This line will significantly enhance the trade potential of the regional states of Southern, Sidama, Southwest, and Oromia. A pre-feasibility study has been conducted, and ERC is awaiting a detailed bankable feasibility study.

The third planned 425km project will connect Dire Dawa with Harar, Jugjiga, and Togo Chale on the border with Somalia, continuing to Hargessa and Port Berbera. ERC is already engaging with stakeholders to drive forward what is considered to be a quick project to implement.