In its report Impact of the Covid-19 crisis on the railway sector in Europe, SCI Verkehr has produced three scenarios: rapid recovery, disrupted markets, and what it believes is most likely, the return of the lock-downs due to new outbreaks of coronavirus later this year.

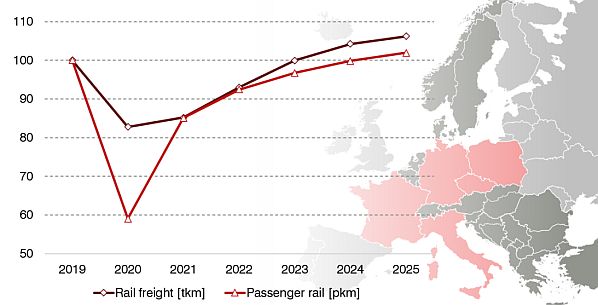

In the event of a renewed lock-down this autumn, SCI Verkehr forecasts a 40% slump in passenger transport for 2020 as a whole, while freight traffic in continental Europe will see a 20% decline. In this situation, SCI does not expect a recovery to pre-crisis levels until 2023 or 2024.

“Since it is currently difficult for everyone to predict future developments, we have decided to work with three clearly defined scenarios which reflect possible developments under different assumptions,” Mr Alexander Herbermann from SCI Verkehr’s Berlin office told IRJ. “Currently, many health experts are assuming one or more additional Covid-19 waves. Therefore this scenario seems probable to us, but other developments are also possible.

“According to our forecast, passenger traffic will slump by 30% this year in the favourable rapid recovery scenario and will have recovered by the end of 2021. In the pessimistic, disrupted markets scenario, traffic will collapse by 50% and will not reach pre-crisis levels until 2025 because passengers have permanently switched to cars or bicycles, business trips are not being made thanks to digital meetings, and commuter traffic is declining overall due to more home office work.”

In the rapid recovery scenario for 2020, SCI Verkehr expects rail freight to account for 87% of the 2019 traffic volume and to recover to the 2019 volume in 2023. In the disrupted markets scenario, SCI Verkehr forecasts rail freight traffic this year at 74% of the level achieved in 2019 and that traffic will only achieve 90% of the 2019 volume by 2025.

“While the high revenue losses incurred by passenger operators will probably be partially compensated by government programmes, freight operators, which are initially less affected, will also come under pressure due to widespread low margins,” says SCI Verkehr. “Lack of investment funds on the part of the railways will have a negative impact on vehicle procurement.”

Pandemic

The first cases of coronavirus in Europe were discovered on January 24 in France followed by Germany and Italy. Countries in continental Europe started to reintroduce border controls after coronavirus cases rose quickly in Italy and Germany. In the beginning, citizens from high-risk countries were not allowed to cross borders to countries which implemented travel restrictions.

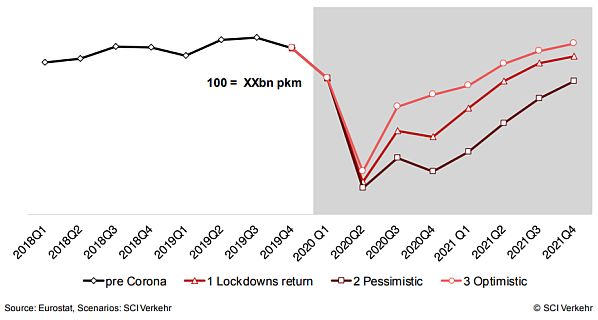

“Since March, Europe has been subject to movement and social distancing restrictions, and the economy is at a standstill in many sectors,” SCI Verkehr says. “Passenger rail transport has been directly affected, with a decrease of over 90%, for example in Italy and France, but only 40% in Sweden, which adopted a less-draconian approach to dealing with the pandemic.

“Rail freight transport has been increasingly affected since April with operators reporting declines of between 20% and 35%, while the transport of new automobiles has come to a complete standstill.

“For the short-term until the end of 2021, the main driver will be the development of the pandemic and social distancing restrictions. How the situation will develop in the coming months and years depends largely on the further course of the pandemic, the duration of the lock-downs and the stabilisation of the economy.”

The study covering the entire European rail market is now available in English from SCI Verkehr in two versions: either for rail freight or only passenger rail with detailed analyses of Germany, France, Italy, Poland, and the Czech Republic.