TURNOVER from the sale of new rail vehicles totalled €56.8bn in 2022, up 5% from €53.9bn in 2021 and higher than the total in 2019, the last year before the Covid-19 pandemic.

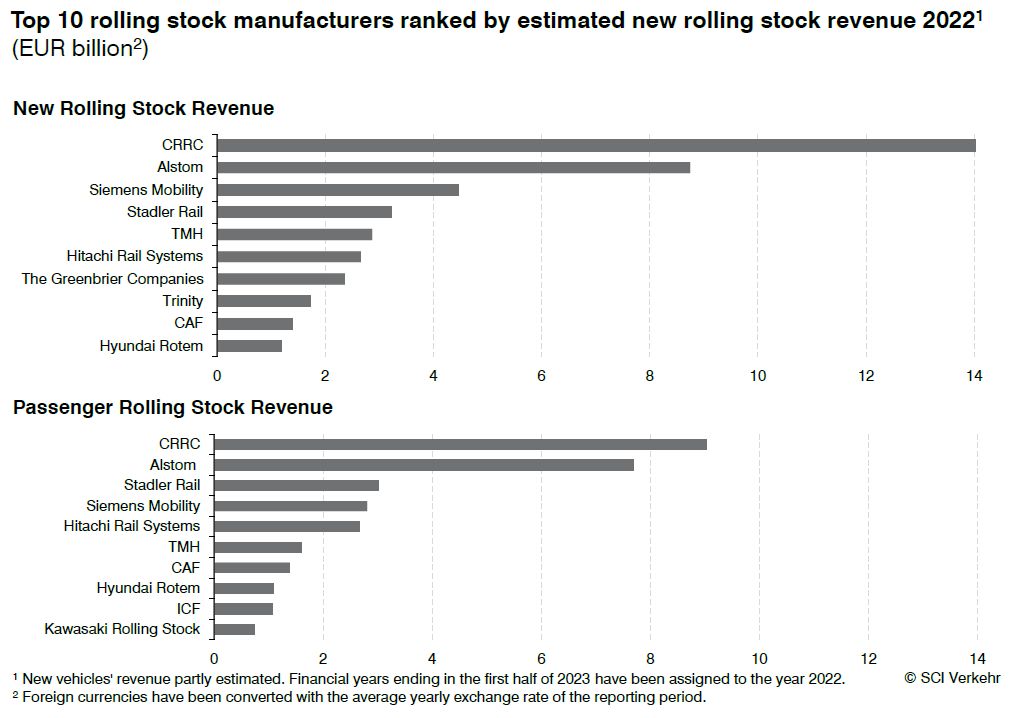

According to a new study from SCI Verkehr, Worldwide Rolling Stock Manufacturers 2023, the top 10 manufacturers accounted for 75% of sales, up from 72% in 2020, with 11 manufacturers each generating new vehicle sales of more than €1bn and five other manufacturers achieving new vehicle sales of more than €500m in 2022.

Compared with the last study published by SCI Verkehr in 2021, there were only minor changes among the 10 largest rail vehicle manufacturers in 2022. Due to the merger of Alstom and Bombardier in January 2021, Siemens now moves up to third place, followed by Stadler Rail in fourth place. Transmashholding (TMH), the largest manufacturer in Russia, remains in fifth place, while Hitachi Rail and The Greenbrier Companies each move up one place.

US wagon builder Trinity Rail returns to the top 10 after a year’s absence, displacing Integral Coach Factory (ICF) of India. Hyundai Rotem is in the top 10 for the first time, behind Spanish manufacturer CAF.

Following a 4% decline to €52.8bn of sales in 2020 and a 2% upturn in 2021, SCI Verkehr expects very stable growth to continue in the future.

Passenger vehicles account for the largest share of revenue worldwide. Within this segment, Stadler is the third largest producer behind CRRC and Alstom, placing the company ahead of Siemens Mobility and Hitachi Rail. Further players among the top 10 passenger vehicle manufacturers are TMH, CAF, Hyundai Rotem, ICF and Kawasaki Rolling Stock.

SCI says many manufacturers succeeded in catching up on production backlogs and fulfilling contractual obligations in 2022.

For detailed data on rolling stock orders from around the world, subscribe to IRJ Pro.