IRELAND published its first National Hydrogen Strategy in July. The country currently sources 80% of its energy from fossil fuel imports. And given concerns over future energy security prompted by the war in Ukraine, the government is seeking to explore other means of sourcing energy.

The strategy states that renewable hydrogen will play an important role in the Irish electricity sector by helping to decarbonise power generation while increasing storage capacity. Interestingly, it suggests the use of green hydrogen to support the decarbonisation of heavy transport sectors, including rail, where battery-based traction is not feasible.

Ireland is targeting a 51% reduction in carbon emissions for the transport sector by 2030 and the recent All-Island Strategic Rail Review conducted by Arup proposes a €37bn investment to decarbonise the rail network. The plan recommends a rolling programme of electrification to enable 80% of train-km to operate with electric rolling stock with battery and hydrogen traction expected to account for the remainder.

Irish Rail (IÉ) is already actively looking at how it can decarbonise its fleet. It is trialling the use of hydro-treated vegetable oil (HVO) in diesel locomotives under a partnership with Rhomberg Sersa Ireland announced in April. If successful, the trial will reduce carbon emissions on these locomotives by 90%. The railway has also taken its first tentative steps into hydrogen traction by agreeing a partnership with Digas Group to retrofit a class 071 locomotive’s existing internal combustion engine to run on hydrogen fuel.

Under the €1.5m project announced on September 14, Digas will manufacture, deliver and install the hydrogen internal combustion engine retrofit on the class 071. IÉ will provide the workshop necessary for installation, testing and commissioning activities and will test the retrofitted locomotive. IÉ will also identify project partners that will provide hydrogen refuelling equipment for the retrofitted locomotive.

The project is currently in design with two testing phases scheduled for 2024 and 2025. Phase 1 will focus on static testing of the locomotive to check power and emissions outputs. The second phase, which will commence in 2025, will focus on service trials on the IÉ network. All designs and testing standards are subject to approval from the Commission for Railway Regulation (CRR).

IÉ has 18 class 071 diesel locomotives, 12 of which are used in freight service. “If the conversion tests are successful, these locomotives can be converted to greener and more efficient alternatives,” said IÉ chief executive, Mr Jim Meade, when announcing the project.

Start-up

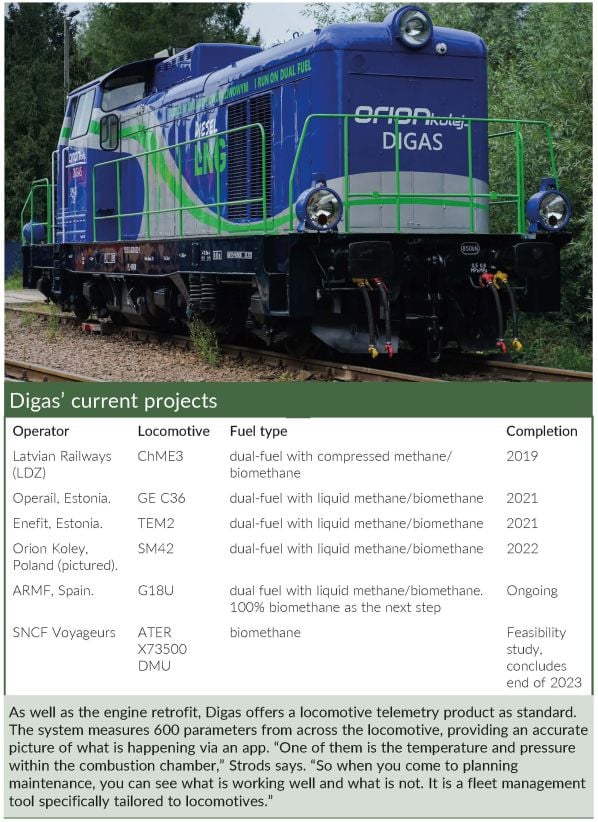

This is Digas’ first hydrogen retrofit project. The Latvian start-up has up to now focused on retrofitting diesel locomotives to run on biomethane as an alternative to diesel. It launched its inaugural project in 2016 with Latvian Railways (LDZ) and has since completed retrofit, certification and commissioning of its system on four different locomotive types in Latvia, Estonia and Poland. Further ongoing projects include with ARMF, Spain, and a feasibility study with SNCF Voyageurs (see panel below).

Digas’ technology is based on a dual-fuel system developed by its founder, Mr Peter Dumenko, who reported success in Eastern Europe in the 2010s, in particular with a 400-strong diesel bus conversion project. Digas was born after a partnership was formed in 2012 with Mr Robert Strods, Digas’ head of business development. Strods’ company at the time was working on a “virtual pipeline” for compressed natural gas, whereby the fuel was shipped in tanks by road to support a bus refuelling project. “We needed someone to retrofit the buses,” Strods says. Enter Dumenko.

“His technology was pretty different from anything I had seen in a couple of ways,” Strods says. “First of all, they inject the gas in each combustion cylinder rather than just a common manifold for all air intake. Second, it controls all the air coming into the cylinders. And third, they were also controlling the diesel fuel injection at all times. You end up controlling all the parameters for combustion, in real time and many times per second, which allowed them to achieve the results they did.”

Strods says that while initially successful in the bus market, the sheer number of OEMs meant it was not the best place to commercialise the technology. Other sectors were considered, such as mining and stationary equipment, as well as rail. “Since we had quite a nice rail market here in the Baltic States, and because of the work to bring similar technologies into the US rail market, we chose rail as the sector to apply our dual-fuel technology,” he says.

The company presented its first retrofitted and certified biomethane locomotive in 2019 after agreeing the project with LDZ on June 1 2016.

“Fortunately for us right now the railway, at least the segments that we are going after, are not so concerned about the local pollutants, they’re more concerned about the CO2.”

Robert Strods, Digas' head of business development

Biomethane is a purified form of raw biogas and can be used as a natural gas substitute. The impact of its use on CO2 emissions varies by region. In Europe it is considered carbon neutral, but in some regions, such as the United States there is a negative effect on CO2 emissions - by between 45% and 382% depending on the source of the fuel, according to California’s CA-Greet3.0 model which measures the carbon intensity of all fuels. This offers a “very enticing value proposition,” Strods says, especially compared with other biofuels.

“The queen of the prom right now is HVO but the problem with HVO is that it is not cost-competitive,” Strods says. “It definitely costs more and can vary from 25-50% to sometimes twice the cost of diesel whereas biomethane can actually cost less than diesel. But again it depends on the country.”

There are around 20,000 biogas plants in Europe, according to data compiled by the European Biogas Association, which have typically been used to generate renewable electricity for power or heating. However, with the share of renewables steadily increasing in the energy mix, Strods says these facilities are being earmarked to support the decarbonation of transport, which remains stubbornly reliant on fossil fuels.

This includes through conversion to produce biomethane, potentially boosting the number of active plants in Europe from around 1300 today. Strods identifies France as a leader in both developing new plants and converting its existing biomethane plants. “That’s a reason why we are focusing our efforts on France for the biomethane locomotive retrofits,” he says.

The locomotive retrofit process is fairly simple, according to Strods. He says the engine is kept as is but modified slightly so that together with air, the gas (biomethane, methane or hydrogen) is drawn into the cylinder, effectively producing a dual-fuel engine by utilising simultaneous combustion of both fuels. The values again vary by region, but Strods says that in Europe generally biomethane-diesel dual fuel offers an 80% reduction in CO2 emissions compared with just diesel. Particulate matter is also reduced by 80% in a dual-fuel solution and NOx by 40%.

Some customers are requesting 100% biomethane and Strods says this requires modification of the engine, including changing the injectors. This compares with dual fuel where auxiliary equipment is added to the original engine. The reduction in the particulate matter emitted by these engines is higher at 95%, while NOx is reduced by 70%.

“It’s a nice reduction but it’s not pollution-free,” Strods says. “But fortunately for us right now the railway, at least the segments that we are going after, are not so concerned about the local pollutants, they’re more concerned about the CO2.”

The process for hydrogen locomotives is similar as it is also a gaseous fuel. Strods says it requires the diesel fuel tank to be removed and replaced with high-pressure storage tanks. He adds that this is one of the few components where Digas will work with an established sub-supplier on the design. For all others, Digas takes care of design, working with sub-suppliers on manufacturing.

“In the Irish project we are going for 100% hydrogen,” Strods says. “We’re changing the diesel injectors to spark plugs, and introducing the hydrogen into the combustion chamber with our own injectors.”

An advantage of using hydrogen in an internal combustion engine is that the purity and quality of the fuel does not have to be as high as in a fuel cell solution. While IÉ is targeting the use of green hydrogen, there is the option to use a lower-quality grade fuel at least initially. Strods says another advantage is that the functions and power and torque performance of the internal combustion engine are already known, meaning that it is straightforward to make comparisons during tests with hydrogen. “As soon as we show on a testing bench that the power and performance is the same as with a diesel, you are good to go,” he says.

A third advantage is the cost. A fuel cell-battery prototype project can cost up to €5m, falling to around €2m when produced at scale, according to Strods, significantly more than the €1.5m cost of the Irish project with the retrofit expected to cost €300,000-400,000 when conducted at scale.

Disadvantages

There are also several disadvantages. Notably, there is a higher fuel consumption when using an internal combustion engine compared with a fuel cell, with the fuel cell much more effective at converting the hydrogen into electrical energy. In addition, the only by-product of electrolysis in a fuel cell is water, whereas the engine will continue to produce some local exhaust emissions. Thirdly, and perhaps most crucially, the need to retain the engine limits the space available for storage of hydrogen compared with a fuel cell rail vehicle where the engine is removed. Inevitably this reduces the range and ultimately the function of the locomotive to less intensive shunting activities, at least initially.

Hydrogen capacity could be boosted by increasing the pressure of the storage tanks. While the standard for hydrogen storage has been 350bar in rail projects up to now, Strods says Digas is targeting 700bar for the Irish project, following a general trend to establish this as the standard in the rail industry.

Digas is also looking at other options such as liquid hydrogen and what Strods describes as conformable hydrogen tanks, which will replace traditional cylinders and could offer a 25-35% boost in hydrogen storage capacity. He says it is likely that this will be adopted for the second IÉ locomotive and could potentially support medium or even heavy shunting operations.

Yet this is still short of the required capacity for mainline operation where realistically only the addition of a tender to transport the hydrogen will offer the scale required, as seen in some heavy-haul applications. This inevitably increases the cost significantly. “There is definitely going to be a market, but it is going to be a niche market, as opposed to converting all diesels to hydrogen,” Strods says. “The internal combustion engine is a bridge. We just believe it is a longer bridge than most people think.”

For its next move, Strods says Digas is set to go down the fuel cell-battery route. “It is the reason we have established a strategic partnership with Hydrogène de France,” he says. “Together with them we will work on their project to modernise a small shunting locomotive with a fuel cell and a battery. This will be our entry point to this space.”

Muscling in on what is an already reasonably well-established market is not a natural territory for a start-up such as Digas, which employs just 15 people, mostly engineers from Latvia and Ukraine. Yet with customers increasingly demanding this type of solution, Strods says it has to be open to such possibilities. He feels in its home market of Eastern Europe it can offer a “cost-competitive solution.” This also includes hybrid and battery-only retrofits, another project on the company’s radar.

One competitive advantage for Digas is its knowledge of the certification process for retrofitting rail vehicles to run on alternative fuels and powertrains. Strods describes this as the most challenging element of any rail project. No other supplier had successfully obtained certification for the retrofit of a locomotive to run on gaseous fuels before Digas achieved this with its project with LDZ. Certification work took two and half years of this three-year project.

This work required the alignment of various parties including national railway safety agencies in various member states to, as Strods describes, come up with the methodology and the standards that would allow Digas and another third party to evaluate that a retrofitted locomotive is safe.

“We have acquired very, very specific knowledge and experience of a methodology of how to do that,” Strods says. “As soon as we aligned the parties along the same methodology, then the process started to run smoothly.” Certification of its latest locomotive took just six months and Strods says a three to four-month process is now feasible. “Not only do we have the technology but we have the know-how of how to do that in the most effective manner - which parties need to be involved and what documents need to be presented,” he says.

Such expertise in certification is why Hydrogène de France invested in Digas, Strods adds, and will be integral to success as the French company scales up its activities in the rail sector.

Digas has also benefitted from financial support from EIT Urban Mobility. The European Union (EU) body provides co-funding to support various urban mobility ventures, including its start-up investment programme where up to €500,000 is available for small companies developing new solutions that contribute to at least one Sustainable Development Goal (SDG). This support has “secured Digas’ back,” according to Strods, enabling the start-up to pursue its ambitious agenda. The company certainly has made encouraging early strides in the traction retrofit market. And with numerous exciting projects on the horizon, it looks primed to benefit as sustainability concerns drive a rethink of how railway vehicles are powered.